The long and short of the OptumRX agreement is to allow patients to be able to pick up and fill a prescription in a retail store versus mail order. That in inself tells me that there’s folks who don’t care for mail order services? In addition, Walgreens will be able to pick up more data to sell as well. OptumRX does it’s share of prescription data selling as well. We might see other types of arrangements surface as remember there are two Hedge Fund executives sitting on the board at Walgreens.

more data to sell as well. OptumRX does it’s share of prescription data selling as well. We might see other types of arrangements surface as remember there are two Hedge Fund executives sitting on the board at Walgreens.

Two Hedge Fund Executives Gain Board Seat Walgreens, Stock Buy Backs To Continue And Increase, As Well Cost Cutting With Products And Maybe Employees

Walgreens Cashing in Big In the Data Selling Epidemic Arena–Incentives Connected to Apps and Devices That Sell, Re-Query and Re-Sell Our Data And Data Profiles

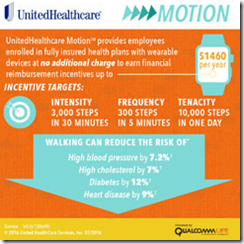

Walgreens and United Healthcare have also ventured together on other projects, as in some areas pharmacists gain some P4P money with getting a customer to sign up for the YMCA. I think there are some matching funds from CDC that come into play here too. A short while back a pharmacist told me that they were told to only sign up patients with United Healthcare with the YMCA and that would make sense based on this agreement at the link below.

UnitedHealth, YMCA Expand Diabetes Prevention Program with P4P forWalgreens

UnitedHealthCare To Use Data Mining Algorithms On Claim Data To Look For Those At “Risk” of Developing Diabetes – Walgreensand the YMCA Benefit With Pay for Performance Dollars to Promote and Supply The Tools

Moving forward Anthem who’s suing Express Scripts wants a judgment that it could terminate its deal with Express Scripts, which goes to 2019, but the Anthem is not sure it would officially end the contract? Below is where Walgreens was charged wtih over charging customers. They all want one thing, money. A couple years ago United and Anthem had a pretty big dispute going and Walgreens is at a disadvantage in the fact that they don’t own a pharmacy benefit manager so are they too going to put more United Healthcare eggs in the basket with OptumRX?

Walgreens Accused of Overcharging Customers-Algorithms-Drug Stores Have to Pay Penalties on Their Issues, Why Does Wall Street Skate When Their Killer Algorithms Attack?

If you have watched the news of late, then you may have noticed that United/Optum RX has figured out there’s big money in distributing drugs and pharmacy benefit managers of course make money with so called kick backs from the drug companies and their distributors. You may not always get the lowest price but rather the drug that pays the PBM the best. Here’s where OptumRX is now in the workman’s comp pharmacy benefit management business with this acquisition of a couple months ago. Pay attention folks as the bigger conglomerates keep getting bigger and bigger and the more say they have, the less say we have.

United Healthcare Buys Helios Workman’s Comp PBM and Their Other Related Businesses

You can see here where OptumRX has already hurt some of the business in Florida with a big move to take some of their business.

Express Scripts To Lay Off 400 People Tampa As United Healthcare Moves Patients To Their Own Pharmacy Benefit Management Company-Subsidiary Watch

By the way, look at how Express Scripts “scores” you with predictive behavior algorithms with 300 metrics that mostly have nothing to do with taking prescriptions. They all do this and I just happend to cover the Express Scripts portion as they brag about it on their website for anyone to see.

Medication Adherence Predictions Enter the World of Quantitated Justifications For Things That Are Just Not True, Members of the Proprietary “Code Hosing” Clubs Out There Destroying Your Privacy

It was back in 2010 that Express Scripts started running medication adherence predictions with the use of Ingenix (United Healthcare) algorithms, so the scoring algorithms get intertwined all over the place for the sake of making money selling “scores” about all of us and with flawed data to boot. The archived post on that one is below.

Ingenix (United Healthcare) algorithms, so the scoring algorithms get intertwined all over the place for the sake of making money selling “scores” about all of us and with flawed data to boot. The archived post on that one is below.

Express Scripts- New Program to Contact and Predict Patients Who May Not Be Taking Their Medicine Based On Ingenix Algorithms–We Want the Revenue Please Don’t Stop

Now with Walgreens working to buy Rite-Aid, they too are using the EQIPP Platform to “score” and take in a bunch of data on predictions. The only problem with this program is that it searches out all kinds of financial data to check on you to find a credit card, or some other transaction to see if you filled a prescription, when, and a lot more. Below are a couple links that goes into detail on why you should pay cash for prescriptions if you want to preserve “some” of your privacy.

Rite Aid Pharmacies are the Latest to Begin Used Flawed Data Provided by the EQuIPP Platform Relative to “Scoring” Patients for Predictive Medication Adherence–The “Outlier” Patients…

Patients Who Pay “Cash” When Filling Prescriptions Are Now Called “Outliers, Pharmacists Required to Fix Outliers as They Show Up As Non Medication Adherence Compliant With 5 Star Systems Full of Flawed Data…

Are you starting to see a pattern here, maybe? If you don’t better dig in a look again as this is all about making money distributing drugs and not so much on saving costs as it’s always billed. Why else would Anthem be suing Express Scripts? In addition you also have FICO doing medication prediction scoress, so easy they say to do with mining data about you is all they need is your name and address and they can score anyone on with what they also call medication adherence scores…la te dah…tons more data about you to sell along with these “scores”.

FICO Medication Adherence Scoring Should Be Banned As It’s Quantitated Justifications for Profit That Hurts US Consumers Using Proprietary Algorithms That Cannot Be Replicated For Accuracy or Audited

Also as a side note, be aware that your voice is being scored for your behavior at the insurance call centers, most of them have these algos to score you and yes these behavior scores get sold too!

“This Call May Be Recorded for Quality Purposes”..Heck Not, Millions of Algorithms Have Been Turned Loose to Listen To and Analyze Your Voice When You Talk To Your Insurance Company As Algorithms Continue To Take Over the World…

So out of this deal with OptumRX, as a patient you get convenience of going to a Walgreens store and both Walgreens and OptumRX benefit on getting more data and scores to sell about you, and those scores are top secret, just try and ask a pharmacist for your medication prediction adherence score sometimes? BD

Unlike CVS, Walgreens doesn’t operate its own drug-benefits business. The deal with OptumRx will probably draw more customers into Walgreens stores, along with boosting drug sales, according to Ann Hynes, an analyst at Mizuho Securities. Express Scripts probably has the most to lose during the employer-benefits selling season, which begins next month, according to Hynes. The company has a similar arrangement with Walgreens, but still tends to push customers to get their drugs by mail.

UnitedHealth’s partnership with Walgreens starts on Jan. 1. Some members with drug coverage from OptumRx may lose the option of filling their prescriptions at pharmacies other than Walgreens under the deal, though that’s up to the employer or other entity that’s making the benefits decision. The deal will also give Walgreens pharmacists more access to information that will help them counsel patients who are on multiple drugs, aren’t getting refills or taking pills that shouldn’t be taken together, said Mark Thierer, chief executive officer of OptumRx.

at Optum (which you have to pay for) with a “discount card” called

at Optum (which you have to pay for) with a “discount card” called