This pertains to one of the call centers and ironically these people get no benefits and might just have to fork out and pay for insurance themselves through the exchange. In reading this article, there seems to be some confusion, mismanagement or both of the above in how many of the jobs were to be full time and how many were to be part time. It sounds like everyone thought they had a full time job until decisions were made. The full time employees work the day shift and the part time fill in after regular hours it sounds like.

It sounds like everyone thought they had a full time job until decisions were made. The full time employees work the day shift and the part time fill in after regular hours it sounds like.

They had over 7000 applications for just over 200 jobs and one person said they quit another job to take this job and found out later it was only going to be part time. Part time pay will range from $15.33 to $18.63 and the part time are given the option of purchasing their own insurance but it runs from $600 a month all the way up to $2900 a month, typical of what we see in many places today so the part timers might really have to depend on getting a break by purchasing their own insurance through exchanges. You can see where the union has become involved too with asking the county to pick up 80% of the cost of the premiums since the employees will be Contra Costa County workers.

I guess things could be worse if they were outsourced to the Philippines, India or elsewhere but I think due to the complexities of the project and the constant changes it will be challenging enough to stay on top of it here without adding that element.. BD

CONCORD -- Earlier this year, Contra Costa County won the right to run a health care call center, where workers will answer questions to help implement the president's Affordable Care Act. Area politicians called the 200-plus jobs it would bring to the region an economic coup.

Now, with two months to go before the Concord operation opens to serve the public, information has surfaced that about half the jobs are part-time, with no health benefits -- a stinging disappointment to workers and local politicians who believed the positions would be full-time.

The worker said no clear reasons for the change were given.

Those who became part-time were told they would have to pay full freight on their health plans, ranging from $600 to $1,200 a month for a single worker and between $1,400 to $2,900 a month for an employee with a family. That is a steep bill for employees with part-time jobs paying from $15.33 to $18.63 an hour.

Another applicant said he ditched another job offer after getting a congratulatory hiring letter from call center operators in June, only to be given the runaround in the months since.

During negotiations months ago, Service Employees International Union Local 1021, which represents the customer service agents, demanded 80 percent of health insurance premiums be paid by the county, and 20 percent be paid by the employee. SEIU did not return a call for comment.

http://www.contracostatimes.com/news/ci_23733819/concord-half-call-center-jobs-will-be-part

an idea as to what big conglomerate benefits with profits to their bottom line. The article states provided via Optum, which is a “tiered” subsidiary of United. Back in October of 2011 we had this with seniors by way of claims/billings/contracts basically getting a free hearing aid if they signed up for a certain United Healthcare policy.

an idea as to what big conglomerate benefits with profits to their bottom line. The article states provided via Optum, which is a “tiered” subsidiary of United. Back in October of 2011 we had this with seniors by way of claims/billings/contracts basically getting a free hearing aid if they signed up for a certain United Healthcare policy. United subsidiary, a company in China working to promote Chinese drugs and devices worldwide to include the US. I3 is a company owned by Minnetonka-based UnitedHealth's technology division and is located in Shanghai.

United subsidiary, a company in China working to promote Chinese drugs and devices worldwide to include the US. I3 is a company owned by Minnetonka-based UnitedHealth's technology division and is located in Shanghai.  he new federal data hub, as United bought the company two weeks after HHS awarded the contract so there’s a lot of buying up government contractors going on here too. All of the tiered subsidiaries allows big conglomerate to “hide under the public radar today”.

he new federal data hub, as United bought the company two weeks after HHS awarded the contract so there’s a lot of buying up government contractors going on here too. All of the tiered subsidiaries allows big conglomerate to “hide under the public radar today”.  of the documentation can stall a claim for up to 120 days or more and MDs need cash flow so again the under coding with getting paid fast versus the delay would win. It even seems that HHS got confused on such items last year when they sent letters out accusing doctor and hospitals of all being cheaters and sure are some but to tell all they were cheaters just pretty much showed the lack of education in how all of this works in my opinion. It made a lot of medical societies and vendors mad as they all saw it the same way and to have Holder from the DOJ sign on too well it gave a damsel in distress type of perception, adding insult to injury.

of the documentation can stall a claim for up to 120 days or more and MDs need cash flow so again the under coding with getting paid fast versus the delay would win. It even seems that HHS got confused on such items last year when they sent letters out accusing doctor and hospitals of all being cheaters and sure are some but to tell all they were cheaters just pretty much showed the lack of education in how all of this works in my opinion. It made a lot of medical societies and vendors mad as they all saw it the same way and to have Holder from the DOJ sign on too well it gave a damsel in distress type of perception, adding insult to injury.  when he filled out the reports weeks after the surgeries, he incorrectly stated that he repaired an aortic aneurysm instead of the type of aneurysm he actually repaired. He was accused of using an incorrect American Medical Association code — a code the government requires doctors use for billing — to bill the government for the procedure he performed, though there is no precise AMA code for the procedure he did.

when he filled out the reports weeks after the surgeries, he incorrectly stated that he repaired an aortic aneurysm instead of the type of aneurysm he actually repaired. He was accused of using an incorrect American Medical Association code — a code the government requires doctors use for billing — to bill the government for the procedure he performed, though there is no precise AMA code for the procedure he did. in the way that it is written to make the company look like they are dishing out tons of money? When they take over more physicians groups, form more subsidiaries look at the real actions going on here. About 6 months ago the AAFP confronted United on paying doctors less than what they get from Medicare in several states and this is the result of complex contracts that pretty much only the lawyers can understand today.

in the way that it is written to make the company look like they are dishing out tons of money? When they take over more physicians groups, form more subsidiaries look at the real actions going on here. About 6 months ago the AAFP confronted United on paying doctors less than what they get from Medicare in several states and this is the result of complex contracts that pretty much only the lawyers can understand today.

you through the airports and if you pay them $85 they won’t check your feet anymore. Well you know what, they can still check my feet. How far is all of this going to go. Do you mean these folks are not part of PRISM (grin).

you through the airports and if you pay them $85 they won’t check your feet anymore. Well you know what, they can still check my feet. How far is all of this going to go. Do you mean these folks are not part of PRISM (grin).  by lawyers who are the absolute worst at running government agencies today, even the DOJ is stuck with digital dud Holder right now. Just watch

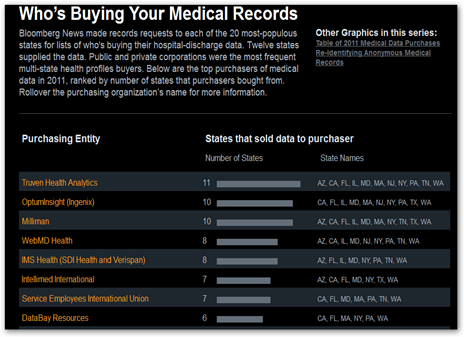

by lawyers who are the absolute worst at running government agencies today, even the DOJ is stuck with digital dud Holder right now. Just watch  watch out as the data sellers battle each other here.

watch out as the data sellers battle each other here.  promoting as yet one more example of reactive solutions for a White House and Congress who can’t model and seem to be afraid of math which is what the other side uses. John Kerry said a few months ago that it was ok to be stupid and 84 Senators who do all their work on paper took him up on it…and that’s what is responsible for making laws today? This program is going to make a lot of money for some companies,

promoting as yet one more example of reactive solutions for a White House and Congress who can’t model and seem to be afraid of math which is what the other side uses. John Kerry said a few months ago that it was ok to be stupid and 84 Senators who do all their work on paper took him up on it…and that’s what is responsible for making laws today? This program is going to make a lot of money for some companies,

a company widely used by mortgage lenders, social service agencies and others — to verify income and employment and could extend the initial 12-month contract, bringing its potential value to $329.4 million over five years. “

a company widely used by mortgage lenders, social service agencies and others — to verify income and employment and could extend the initial 12-month contract, bringing its potential value to $329.4 million over five years. “

only with little or no balance with ethics and the real world. Remember all the complexities here are built around the insurance models created by the health insurance industry though and if you think they are just about insurance anymore

only with little or no balance with ethics and the real world. Remember all the complexities here are built around the insurance models created by the health insurance industry though and if you think they are just about insurance anymore  insurance will still be sold in California by Anthem just not via an exchange. Anthem also operates their own private exchange called

insurance will still be sold in California by Anthem just not via an exchange. Anthem also operates their own private exchange called  software here’s yet one more offering from WellPoint if you are a business with 100 employees or more, as a company you can stick employees with one more website to use for analytics so they can just get a simple office visit and know every last penny of what the cost will be and the company can cap what they want to spend on many procedures and treatment.. Wonder why insurance is so costly with all this software, oh those 3rd party business consultants and associates that figure more ways to put the consumer in front of a computer screen to just get their healthcare taken care of.

software here’s yet one more offering from WellPoint if you are a business with 100 employees or more, as a company you can stick employees with one more website to use for analytics so they can just get a simple office visit and know every last penny of what the cost will be and the company can cap what they want to spend on many procedures and treatment.. Wonder why insurance is so costly with all this software, oh those 3rd party business consultants and associates that figure more ways to put the consumer in front of a computer screen to just get their healthcare taken care of.  Mutual purchased Carolina Care Plan and I am assuming this is the big portion of the policy holders that will be moved over to United.

Mutual purchased Carolina Care Plan and I am assuming this is the big portion of the policy holders that will be moved over to United.  Community Health Systems..only problem is HMA has their own problems with subpoenas from July of 2011 too, see link below. A couple months ago the HMA CEO got out of Dodge with a hedge fund chasing him down the road.

Community Health Systems..only problem is HMA has their own problems with subpoenas from July of 2011 too, see link below. A couple months ago the HMA CEO got out of Dodge with a hedge fund chasing him down the road.  , same everything and those testifying we doing a good job trying to explain. Baucus appeared to want a simple answer to all of this and believe me if there was one, it would have been there but he doesn’t get it with complexities of IT Infrastructure today.

, same everything and those testifying we doing a good job trying to explain. Baucus appeared to want a simple answer to all of this and believe me if there was one, it would have been there but he doesn’t get it with complexities of IT Infrastructure today.

proposed there either that is substantial sadly so I guess it’s good to listen in once in a while and see what levels of discussion are being had? When the Snowden issue came out and we had Diane Feinstein talking about technology she has never touched, what in the world do you think the technologist out there thought?

proposed there either that is substantial sadly so I guess it’s good to listen in once in a while and see what levels of discussion are being had? When the Snowden issue came out and we had Diane Feinstein talking about technology she has never touched, what in the world do you think the technologist out there thought?  real duck? That’s an example of what real world folks like me deal with when it comes to data and the errors and yet we are stupid? I’ll put a ton of consumers up against what I heard yesterday (grin).

real duck? That’s an example of what real world folks like me deal with when it comes to data and the errors and yet we are stupid? I’ll put a ton of consumers up against what I heard yesterday (grin).  and formulas running on servers so again when I listened yesterday there was no hint of any of this type of knowledge coming from the Senators..scary. Here’s a former quant that will lay it out for you and she has a great lecture series called “Weapons of Math Destruction”..good to listen in as she worked for a hedge fund and did the math for Larry Summers..her comments are good and truthful. I said pretty much the same type of thing with the

and formulas running on servers so again when I listened yesterday there was no hint of any of this type of knowledge coming from the Senators..scary. Here’s a former quant that will lay it out for you and she has a great lecture series called “Weapons of Math Destruction”..good to listen in as she worked for a hedge fund and did the math for Larry Summers..her comments are good and truthful. I said pretty much the same type of thing with the  The vendor and the hospital have done business together for 24 years. The vendor is demanding $285,097.03 in unpaid services from the hospital and has remotely disconnected the hospital from their servers. The hospital claims the vendor refused to provide a drive with all the patient records as well. Milwaukee Health Services, the hospital takes care of much of the under served patients and has not been able to access records since July 1st and has filed a lawsuit. The hospital could use a little work on their website but maybe this is temporary due to the switch to GE Centricity. If they are live on the new system, and without the past history, all would have a file as a “new” patient for the time being until this is resolved but no access to past history.

The vendor and the hospital have done business together for 24 years. The vendor is demanding $285,097.03 in unpaid services from the hospital and has remotely disconnected the hospital from their servers. The hospital claims the vendor refused to provide a drive with all the patient records as well. Milwaukee Health Services, the hospital takes care of much of the under served patients and has not been able to access records since July 1st and has filed a lawsuit. The hospital could use a little work on their website but maybe this is temporary due to the switch to GE Centricity. If they are live on the new system, and without the past history, all would have a file as a “new” patient for the time being until this is resolved but no access to past history.

why that was but they got the contract. United Healthcare has truckloads of subsidiaries an as in the Tri-Care bidding situation they create yet another new subsidiary for business they want to pursue.

why that was but they got the contract. United Healthcare has truckloads of subsidiaries an as in the Tri-Care bidding situation they create yet another new subsidiary for business they want to pursue.  me might be thinking twice before inviting them to bid as if they don’t get the contract they’ll take you to court and tell you how to award your contracts. BD

me might be thinking twice before inviting them to bid as if they don’t get the contract they’ll take you to court and tell you how to award your contracts. BD

word “profit’. That’s the problem as now more see it as an opportunity to run some queries and “flip algorithms” for profit. Again we do need to license and tax these folks, soon. Billions and I mean billions are made with intangible resources, aka data selling and when it’s wrong and contains errors, who fixes it for free..we do, after they have made their profits. I benefited from the scanner being used and had my stolen purse returned to me by police even before I knew it was missing due to a scanner identifying a stolen care that was drive by the thief, so there is real use for it when done properly. It was odd as the police by the time they called me had already recovered my purse and I didn’t know it was missing yet as I was not carrying it and it had been a break in to where I lived.

word “profit’. That’s the problem as now more see it as an opportunity to run some queries and “flip algorithms” for profit. Again we do need to license and tax these folks, soon. Billions and I mean billions are made with intangible resources, aka data selling and when it’s wrong and contains errors, who fixes it for free..we do, after they have made their profits. I benefited from the scanner being used and had my stolen purse returned to me by police even before I knew it was missing due to a scanner identifying a stolen care that was drive by the thief, so there is real use for it when done properly. It was odd as the police by the time they called me had already recovered my purse and I didn’t know it was missing yet as I was not carrying it and it had been a break in to where I lived.