This problem is expanding into Kentucky now. I have heard it for years in California with different doctors groups over and over complaining that their net reimbursement from United Healthcare is less than Medicare. For those why buy insurance plans from exchanges, in many areas United pays somewhere between Medicare and Medicaid rates and that they have published themselves. In California, complex contracts are used as part of the tools to keep the compensation low. We keep reading all the time about the expense of doctors and a while back there was a study that came out and it said doctors are not that expensive compared to all the other costs in healthcare.

So if you do find your doctor not in network with United, this could be part of the problem, being paid at rates that are 12% average less than what Medicare pays. Of course, our current CMS head, Andy Slavitt drove this payment factorization to pay doctors less during his time at United Healthcare, so if confirmed at Head of CMS, that’s what’s there for those who are members, paying doctors even less and dumping more cost to the consumer. The doctors in this group said they have not had a raise in 6 years with United. Sometimes doctors are accepting less than Medicare and still get fired from United if the algorithmic formulas United uses says no, so they get fired by the algorithms as well.

that are 12% average less than what Medicare pays. Of course, our current CMS head, Andy Slavitt drove this payment factorization to pay doctors less during his time at United Healthcare, so if confirmed at Head of CMS, that’s what’s there for those who are members, paying doctors even less and dumping more cost to the consumer. The doctors in this group said they have not had a raise in 6 years with United. Sometimes doctors are accepting less than Medicare and still get fired from United if the algorithmic formulas United uses says no, so they get fired by the algorithms as well.

United Healthcare Extending Narrow Networks in California–More Secret Scoring of Doctors in the US–Telling The Doctors If They Are “Allowed” To Be In Network…

“The Secret Scoring of America’s Physicians” - Algorithmic Math Models For Insurance Network Contractual Exclusions, Relating to MDs Who See Medicare Advantage Patients..

The company also has a law firm in New York looking into the reimbursement issues.

Law Firm Investigating UnitedHealthCare Claim Payments in New York Stating Under-Reimbursement By Manipulating Algorithmic Benefit Calculations…

A couple yeas ago the American Academy of Family Practice doctors took up this issue as well with United paying doctors at at rates less than Medicare, so it’s all over the US as an issue. Don’t be fooled anymore and think that commercial insurers make up for the low payments of Medicare as they don’t always anymore. There’s enough here in this post to substantiate that.

AAFP Says We’re Not Going To Take It Anymore With Optimization of Provider Networks - Specifically United Healthcare’s Doctor Dumping That Disrupts Continuity of Care

Is there any reason why doctors are not really happy with United? Here a couple years ago they put out an article telling the Feds to aggressively manage seniors and they are trying not only manage seniors but everyone else it seems. BD

United HealthCare Issues Another Study, This One Telling Government To Aggressively Manage Medical Care For Seniors-An Area Where A Large Chunk of Their Revenue Comes From Today, Managing Care

It’s really not fair to the other insurers as well to have this United/Optum monopoly at HHS and CMS that exists today and has been around for years. CMS now is stuck with a lot of the mentored United models that are not working so well as that’s all they do is numbers when it comes to insurance. BD

Local doctors who are part of Highland District Hospital’s Professional Services Corporation will no longer be part of the United Healthcare network because they say United’s reimbursement rates have not been increased in six years.

The doctors say the rates have remained unchanged even after three years of negotiations, and that current rates are, on average, 12 percent lower than even Medicare rates as well as the rates paid by most other commercial health insurance carriers.

they might find or what they are doing. Why spend all this money? CVS is making money hand over fist and the Affordable Care Act Czar Nancy DeParle sits on their board raking in the money for goodness sakes.

they might find or what they are doing. Why spend all this money? CVS is making money hand over fist and the Affordable Care Act Czar Nancy DeParle sits on their board raking in the money for goodness sakes.  selling our data every year.

selling our data every year.

get more data to sell.

get more data to sell.  the large number of “Quants” the insurance business has hired. You could say these folks are a step above the actuaries as they work with different models and actually at some point they might even be auditing the work of an actuary. Sometimes a Quant will use the same math model as an actuary as well, even though they may not openly admit it, but it happens. I started noticing this years ago, especially with United Healthcare as so many of their subsidiaries are not insurance and work around the software, analytics, hearing aids, etc. that they sell, and oh yes, let’s not forget their hospice for profit subsidiary too. If you don’t know what a Quant is or what they do, scroll on down to the footer and watch video #2, the Quant documentary and it tells about what they do in banking and just relate that to health insurance as what we get are financial models that have been somewhat modified to use in the health insurance business.

the large number of “Quants” the insurance business has hired. You could say these folks are a step above the actuaries as they work with different models and actually at some point they might even be auditing the work of an actuary. Sometimes a Quant will use the same math model as an actuary as well, even though they may not openly admit it, but it happens. I started noticing this years ago, especially with United Healthcare as so many of their subsidiaries are not insurance and work around the software, analytics, hearing aids, etc. that they sell, and oh yes, let’s not forget their hospice for profit subsidiary too. If you don’t know what a Quant is or what they do, scroll on down to the footer and watch video #2, the Quant documentary and it tells about what they do in banking and just relate that to health insurance as what we get are financial models that have been somewhat modified to use in the health insurance business.  that contains a lot of “scores” about you, and in turn, they buy a lot of this data as well. A while back I commented about this as I saw this coming for a few years…

that contains a lot of “scores” about you, and in turn, they buy a lot of this data as well. A while back I commented about this as I saw this coming for a few years…

why the other insurers have not complained but how do they go up against such a massive conglomerate that’s into everything via hundreds of subsidiaries?

why the other insurers have not complained but how do they go up against such a massive conglomerate that’s into everything via hundreds of subsidiaries?  much software and algorithms have gone into this process. If you read my recent post about Express Scripts, you’ll understand. The metrics that are being used today are over the top and there’s a lot of money being made “scoring” and selling those scores to anyone who has the money and wants the data.

much software and algorithms have gone into this process. If you read my recent post about Express Scripts, you’ll understand. The metrics that are being used today are over the top and there’s a lot of money being made “scoring” and selling those scores to anyone who has the money and wants the data.  data can’t track everything. Again we are not disputing monitoring those with chronic conditions to see if they are filling their prescriptions here as the issue as that’s pretty normal anymore to take a quick look and see but rather the “scoring” of those at a one star level who pay cash.

data can’t track everything. Again we are not disputing monitoring those with chronic conditions to see if they are filling their prescriptions here as the issue as that’s pretty normal anymore to take a quick look and see but rather the “scoring” of those at a one star level who pay cash.  their systems they use. Just a couple days ago we had this to where Covered California insured participants are getting screwed on privacy with no opt out on being “scored” again and all these so called “scores” which eventually end up denying care or money are going to CMS.

their systems they use. Just a couple days ago we had this to where Covered California insured participants are getting screwed on privacy with no opt out on being “scored” again and all these so called “scores” which eventually end up denying care or money are going to CMS.  Humana will operate as they have. We know down the road this will change but for now it seems to be like a subsidiary. United has been clawing up the back side of Humana on contracts as well with pricing themselves cheaper.

Humana will operate as they have. We know down the road this will change but for now it seems to be like a subsidiary. United has been clawing up the back side of Humana on contracts as well with pricing themselves cheaper. as well as with United we have a lot of Secret Scoring of Doctors going on here. It’s actually gone on in California for a while as I have had conversations with doctors who have been dropped by Aetna and actually a couple of them said “what a relief” to not have to be bound to all those performance algorithms as usually one really sick patient puts them out of the “algorithm” quality game anyway and there’s nothing they can do when such occurs. So that’s a little bit about how doctors get fired, one sick patient and they can’t fiddle the numbers enough to Aetna’s satisfaction, they’re out as well as the big mess of red tape the doctors have to deal with to be in network. United does the same thing and has fired quite a few doctors in California. Both Aetna and United both bailed out of the individual policy programs in California last year and probably for good reason as the networks were so limited, it was very hard to find doctors within those networks.

as well as with United we have a lot of Secret Scoring of Doctors going on here. It’s actually gone on in California for a while as I have had conversations with doctors who have been dropped by Aetna and actually a couple of them said “what a relief” to not have to be bound to all those performance algorithms as usually one really sick patient puts them out of the “algorithm” quality game anyway and there’s nothing they can do when such occurs. So that’s a little bit about how doctors get fired, one sick patient and they can’t fiddle the numbers enough to Aetna’s satisfaction, they’re out as well as the big mess of red tape the doctors have to deal with to be in network. United does the same thing and has fired quite a few doctors in California. Both Aetna and United both bailed out of the individual policy programs in California last year and probably for good reason as the networks were so limited, it was very hard to find doctors within those networks.  of interest loophole kept them from having to pay doctors for the 15 years of Ingenix (United Healthcare) bad algorithm use to gain bigger profits. Here’s the original settlement that was announced and Aetna never paid at the links below. In addition, remember who’s running Medicare today? It’s the former CEO of Ingenix, Andy Slavitt who created all these algorithms and formulas that allowed insurers to collect unprecedented amounts of money that was flawed but yielded bigger profits for insurers. Interesting as Aetna never paid this but took a write off for it. Couple back links below on the history of this.

of interest loophole kept them from having to pay doctors for the 15 years of Ingenix (United Healthcare) bad algorithm use to gain bigger profits. Here’s the original settlement that was announced and Aetna never paid at the links below. In addition, remember who’s running Medicare today? It’s the former CEO of Ingenix, Andy Slavitt who created all these algorithms and formulas that allowed insurers to collect unprecedented amounts of money that was flawed but yielded bigger profits for insurers. Interesting as Aetna never paid this but took a write off for it. Couple back links below on the history of this.  of getting a somewhat accurate listing of doctors out there any more with insurers? Good luck as those in Congress and otherwise like us are just frustrated to no end and as long as most of areas of insurance are run by cost algorithms rather than a care focus, this problem will not go away but rather get worse with trying to figure out who’s in network any more. Again you just have to laugh at these so called “experts” with no data mechanics logic demanding that insurers do a better job with listing doctors in networks as the insurers themselves are victims of their own complexities they built and the “experts” seem to be too dumb to see it and keep demanding change. Those experts are looking for some Algo Fairies indeed, what I call frequently refer to as the “Sebelius Syndrome”.

of getting a somewhat accurate listing of doctors out there any more with insurers? Good luck as those in Congress and otherwise like us are just frustrated to no end and as long as most of areas of insurance are run by cost algorithms rather than a care focus, this problem will not go away but rather get worse with trying to figure out who’s in network any more. Again you just have to laugh at these so called “experts” with no data mechanics logic demanding that insurers do a better job with listing doctors in networks as the insurers themselves are victims of their own complexities they built and the “experts” seem to be too dumb to see it and keep demanding change. Those experts are looking for some Algo Fairies indeed, what I call frequently refer to as the “Sebelius Syndrome”.  question now is United I suppose with coming in as a bigger fish here and again the question of why is a former United Healthcare Executive and one time Goldman Sachs banker running Medicare? There’s way too much power in that spot with even just timing the $70 billion dollar fraud money back program.

question now is United I suppose with coming in as a bigger fish here and again the question of why is a former United Healthcare Executive and one time Goldman Sachs banker running Medicare? There’s way too much power in that spot with even just timing the $70 billion dollar fraud money back program.  doctor to prescribe the test either. I don’t know if this test was singled out to be first or not, but it’s not a bad start.

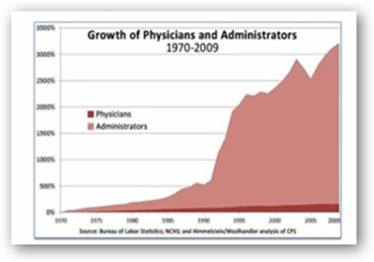

doctor to prescribe the test either. I don’t know if this test was singled out to be first or not, but it’s not a bad start. such managed care contracts. If you look at the image below you can get a better idea of the companies that belong to the conglomerate. US Script is yet another pharmacy benefit manager. You may want to read this link below and see what’s going on there as many but not all PBMs are diving out over their heads with “predictive” medication adherence which is different than normal medication compliance programs.

such managed care contracts. If you look at the image below you can get a better idea of the companies that belong to the conglomerate. US Script is yet another pharmacy benefit manager. You may want to read this link below and see what’s going on there as many but not all PBMs are diving out over their heads with “predictive” medication adherence which is different than normal medication compliance programs.