This is a switch as the shoe goes on the other foot this time and insurers will have to put their Quants to work to create new models. Of late I have noticed health insurance companies picking up the pace with hiring more Quants to model versus a total reliance on actuaries, and let’s face it when’s the last time you have seen an actuary write python, C+, R or any of the other computer code languages that are used today…may find some isolated instances but the Quants or Data Scientists (and all data scientists are not Quants) are where businesses are turning today. I wrote about this yesterday at the link below. If you don’t quite understand what a Quant does, there’s a documentary video in the footer of my blog called “Quants, The Alchemists of Wall Street”“ and you can learn about what they do as it’s probably the best v ideo I have seen that takes this to the layman’s level so you get the overall picture of what they do.

ideo I have seen that takes this to the layman’s level so you get the overall picture of what they do.

President Obama to Meet With Insurance CEOs–White House Changes Made Yesterday to Extend Policies Now The Question Arises On How Are Insurers Going to Model and Implement?

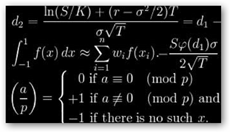

Quants and data scientists do have a code of ethics that basically are self created to keep honest and it is somewhat of an extension of the Hippocratic Code of Ethics created by two financial quants called the “Financial Modeler’s Manifesto". If one is a doctor then you know about the medical “Hippocratic Oath” to practice medicine. I mention the Oaths as they are very important in the times we live in today as models and computer code can fool, disrupt and sometimes be totally flawed and very few are called on for accountability. Watch the first video in the footer, “Context is Everything” and Professor Siefe will explain a lot of what you see and the importance of context. Context is getting harder to define as well today with complexities. In the “Quant” video it’s extremely interesting to hear Paul Wilmott, the #1 Quant in the world state “we’ll just use six” when he explains a situation to where a math model could not be theoretically produced and to me anyway, that has echoes of LIBOR if you will. The code of ethics is there to ensure accuracy and also states that modelers can and should report their employers should they be asked to write code and models that are not accurate and ethically sound. To the right is a book by Emanuel Derman who talks about his life as a Quant so again the emergence of more Quants in health insurance is easily verified by looking at classifieds of late.

interesting to hear Paul Wilmott, the #1 Quant in the world state “we’ll just use six” when he explains a situation to where a math model could not be theoretically produced and to me anyway, that has echoes of LIBOR if you will. The code of ethics is there to ensure accuracy and also states that modelers can and should report their employers should they be asked to write code and models that are not accurate and ethically sound. To the right is a book by Emanuel Derman who talks about his life as a Quant so again the emergence of more Quants in health insurance is easily verified by looking at classifieds of late.

Big Data–The Data Science Code of Ethics-Designed By Those Who Create Models - Don’t Fall Victim To Write Fictitious Code and Models Just to Make Money With Clients Demanding Such

Here’s a few lines from what I just discussed….

“Rule 8 - Data Science Evidence, Quality of Data and Quality of Evidence

(a) A data scientist shall inform the client of all data science results and material facts known to the data scientist that will enable the client to make informed decisions, whether or not the data science evidence are adverse.

(b) A data scientist shall rate the quality of data and disclose such rating to client to enable client to make informed decisions. The data scientist understands that bad or uncertain data quality may compromise data science professional practice and may communicate a false reality or promote an illusion of understanding. The data scientist shall take reasonable measures to protect the client from relying and making decisions based on bad or uncertain data quality.

(c ) A data scientist shall rate the quality of evidence and disclose such rating to client to enable client to make informed decisions. The data scientist understands that evidence may be weak or strong or uncertain and shall take reasonable measures to protect the client from relying and making decisions based on weak or uncertain evidence.

(d) If a data scientist reasonably believes a client is misusing data science to communicate a false reality or promote an illusion of understanding, the data scientist shall take reasonable remedial measures, including disclosure to the client, and including, if necessary, disclosure to the proper authorities. The data scientist shall take reasonable measures to persuade the client to use data science appropriately.”

“(g) A data scientist shall use reasonable diligence when designing, creating and implementing algorithms to avoid harm. The data scientist shall disclose to the client any real, perceived or hidden risks from using the algorithm. After full disclosure, the client is responsible for making the decision to use or not use the algorithm. If a data scientist reasonably believes an algorithm will cause harm, the data scientist shall take reasonable remedial measures, including disclosure to the client, and including, if necessary, disclosure to the proper authorities. The data scientist shall take reasonable measures to persuade the client to use the algorithm appropriately.”

Now coming back around to business models it’s a known fact that all industries use models and algorithms to run their businesses today so with the President making a change here, of course we will have tons of news articles asking “is this legal”…as that’s the protocol out there today on everything. Keeps lawyers in the writing business too:) What the President did, was some thing ethical here to help consumers by allowing the extension. Was there pressure for him to do this, yeah, sure was, all over the news with policy cancellation stories and member of Congress backing the extension and the House just passed the bill. So we ask here, a decision was made to help consumers and this is 5% of the number of insured population in the US, so is this going to break the bank? I don’t think so but yes it will impact the overall projections of the ACA and the models from insurers. That’s what they are worried about as now they have to create new models to accommodate the government this time and have a short time to do it. This is why you keep reading that premiums “may” go up as they have to “model” their numbers again.

Provisions of Affordable Care (Complexities) Act to Help Eliminate “Under-Insuring” Ends Up With Insurance Companies Cancelling Many Policies, Most Offering Replacements And Conversions and Some Not, What’s Next…

Not only are the insurers looking at their models but states too are looking at the over all impact as you read. What affect is that going to have on the over all “pools” of participants. Sometimes I tend to think that the whole concept of insurance has been over defined with “segmentation” as when you have so many separate pools with assigned risk dollar assessments, how do you come back around to spreading the cost over a large enough group? That’s very basic model of insurance to begin with and as you read in the news it’s becoming much more difficult to model.

The overall idea behind the ACA is a good one to provide “real” insurance polices that cover basics so we all do get the important items covered; however with the sale of the “bare bones” policies that has taken place over the last few years, it’s more difficult to model and again use smaller risk assessment pools to formulate an answer, so yes insurers are not happy about having to “re-model” if you will. If you remember the White House was pretty cornered into this decision as insurer models and methodologies didn’t leave a lot of choice. The methodologies of how cancelations of policies was handled was the decision of each insurer and I don’t have to explain that further as it’s been all over the news.

The website has played it’s role here too and hopefully we will see some  changes made there with procurements with the government as current methodologies are outdated and actually the last Oversight Hearing I thought was very good as both sides were learning about the other and and if you keep that focus rather than an political spin perhaps good changes will be made there too. I say the last hearing as you had the folks, the technologists who do the work instead of an agency “figurehead” actually giving intelligent feedback. The more I heard the more empathy I had for Henry Chao as well. I read the 176 pages and that was enough for me to comprehend the complexities of the design of the site he was dealing with and basically in my opinion there was too much code being written and not enough of a mix of “off the shelf” integrated products used, so again that comes back to procurement as contractors will bid a job sometimes with provisions to allow them to write a ton of custom code instead as it means more money for them. With Healthcare.Gov that time element was not there to write so much code from the bottom up, so again we come back to procurement and having folks in charge who can add those elements on complex IT Infrastructure jobs.

changes made there with procurements with the government as current methodologies are outdated and actually the last Oversight Hearing I thought was very good as both sides were learning about the other and and if you keep that focus rather than an political spin perhaps good changes will be made there too. I say the last hearing as you had the folks, the technologists who do the work instead of an agency “figurehead” actually giving intelligent feedback. The more I heard the more empathy I had for Henry Chao as well. I read the 176 pages and that was enough for me to comprehend the complexities of the design of the site he was dealing with and basically in my opinion there was too much code being written and not enough of a mix of “off the shelf” integrated products used, so again that comes back to procurement as contractors will bid a job sometimes with provisions to allow them to write a ton of custom code instead as it means more money for them. With Healthcare.Gov that time element was not there to write so much code from the bottom up, so again we come back to procurement and having folks in charge who can add those elements on complex IT Infrastructure jobs.

House Oversight Committee Testimonies Today With Technologists Was Informative, Had Good Questions and Answers and Everyone Was an Adult

What is interesting too is the commenting from the American Academy of Actuaries warning of negative effects and again they have their projections and models and state this will make the market unstable, well is it stable now? We all know we need a big buy in from “healthy young folks” to spread the cost and that’s not being met so far. So if the rate changes have to be approved by state insurance regulators, so be it and get some Quants involved to model it further from where the actuaries leave off if needed. If the laws of some states need to be modified, then I guess that is what will have to be done in order to allow “consumer relief” as it’s needed. Quants can do a good job with auditing quite a few actuary assessments too.

Quants involved to model it further from where the actuaries leave off if needed. If the laws of some states need to be modified, then I guess that is what will have to be done in order to allow “consumer relief” as it’s needed. Quants can do a good job with auditing quite a few actuary assessments too.

If insurers could create a model for the 5% that would facilitate the conversions then therein might lay the answer. They are going to have to look at their models anyway. If you have not figured this out yet, Obamacare or the ACA, which ever name you choose, is the “continuous rise and fall of the machines”…just like the markets…and this gets us one step closer to “digitally centric laws” to tie specific IT Infrastructures to the verbiage of today’s laws (and that is a big change as well with methodologies) as a partial solution or we will keep fighting this battle over and over and over. Granted it won’t fix all but with technologies today it’s very difficult to have a law remain 100% stationary in rules and ethics to work along side business intelligence models that can and do change by the minute. Gov has to model too and needs some work along those lines.

Obamacare: The Continuous Rise and Fall Of The Machines With Complex Insurance Math Models Resulting In Spasmodic, Executing “Killer Algorithms”–And Gov Can’t Model…

You can go one step further here, which I did with an opinion piece and stated that banks and insurance companies in essence have morphed into not much more than huge software companies that control a lot of money and access. That was actually a strange alliance of minds where I said the incognito banker called it right on the head. Whether it’s a stock exchange or an insurance exchange too with complexities today you will have glitches. So what is an Algorithm and the Model? This video below is a very simple demonstration on how modeling and algorithms are created and work and it gives you the basic on how models and algorithms work together, so just imagine the number of “people in the room with or without insurance”, what they pay and how they can be grouped together with calculations and risk. Here’s a good essay from Cathy O’Neil “On Being A Skeptic” as complexities rise today modelers play a more important role than ever and we will be seeing how this plays out with health insurance more and more. BD

So far, two states — Washington and Vermont — have announced that they will not allow their health insurers to extend insurance policies that do not comply with minimum standards set by the 2010 Affordable Care Act, the health-care law widely known as Obamacare.

Three other states — Ohio, Florida and Kentucky — announced that they would allow the renewals. At least eight states and the District of Columbia said they are trying to decide what to do in the wake of Obama’s announcement Thursday, which was intended to deal with a political furor over the cancellation of many Americans’ individual insurance policies because they do not meet the minimum requirements for coverage.

Among the 15 executives participating were the CEOs of Aetna, Humana, CareFirst, Kaiser Permanente and the Blue Cross Blue Shield Association. The administration side included  Marilyn Tavenner, administrator for the Centers for Medicare and Medicaid Services (CMS); Denis McDonough, the White House chief of staff; and Valerie Jarrett, a senior Obama adviser.

Marilyn Tavenner, administrator for the Centers for Medicare and Medicaid Services (CMS); Denis McDonough, the White House chief of staff; and Valerie Jarrett, a senior Obama adviser.

After the president’s announcement, insurers said that although they appreciate Obama’s effort to address consumer concerns, they are worried that the move could distort the risk pool in the new state and federal health-insurance marketplaces. That is because individual policies tend to be significantly more expensive than group insurance, except for customers who are young, healthy and use little medical care — the very people whom federal officials are counting on to join the new exchanges.

The American Academy of Actuaries was among the groups that immediately warned of negative effects if insurers were to keep offering those previous plans. The White House’s approach is “threatening the viability” of the new insurance marketplaces, said Corri Uccello, the academy’s senior health fellow.

http://www.washingtonpost.com/politics/obama-grapples-with-resistance-from-states-insurers-to-his-health-insurance-fix/2013/11/15/24d666ae-4e17-11e3-be6b-d3d28122e6d4_story.html

0 comments :

Post a Comment