As you should be aware today everything requires an IT infrastructure to run and if you have not come to terms with that, well it is what it is. It seems like we have the same old problem here with yet another attorney trying to make headway in a very high tech world with more low tech solutions and maybe just a lot of political talk? Sure the issues are addressed but no real solution talked about at all. It’s not just limited to the FTC as we have the same thing going on with reviving Glass-Steagall with a low tech partial solution for a very complex high tech problem. Without an IT infrastructure to regulate, all this goes nowhere sadly. I have full respect for Elizabeth Warren but again we have have “low tech” solutions out there that are merely band aids for big problems. I keep blogging about restoring the Office of Technology Assessment for Congress and there’s never been a time when we have had such digital illiteracy with our Lawmakers and this would help them.

tech solutions and maybe just a lot of political talk? Sure the issues are addressed but no real solution talked about at all. It’s not just limited to the FTC as we have the same thing going on with reviving Glass-Steagall with a low tech partial solution for a very complex high tech problem. Without an IT infrastructure to regulate, all this goes nowhere sadly. I have full respect for Elizabeth Warren but again we have have “low tech” solutions out there that are merely band aids for big problems. I keep blogging about restoring the Office of Technology Assessment for Congress and there’s never been a time when we have had such digital illiteracy with our Lawmakers and this would help them.

Glass-Steagall Revival Presents a “Low Tech” Partial Solution for an Industry that Needs “High Tech” Regulation-Consumers Get 5 More Years of Bank Modeling For Inequality With Segmentation - No Real Regulation In Sight

Another good example of a real lack of any IT infrastructure back bone is the consumer financial agency run by Richard Cordray, yet one more lawyer trying to keep up with the high tech world. Put some technologists in charge and back them up with a full force of lawyers for goodness sakes as they all seem to be swimming in a pool of neglect when it comes to the power of math models and algorithms as they function today in the business world. Hire a few quants from the business world who know it functions and cut to the chase by all means. I don’t mean any disrespect here for anyone but it’s time to get off the pot in so many words as current efforts are going nowhere and totally ignore the impact on how technology is being used today.

Richard Cordray, Fail With Understanding Flawed Models and Algorithms -Big Case of“Algo Duping”With Big Data-Save Time, Hire Quants Who Know How Consumer Financial Models Are Built and Function…Geez

The agency, the FTC is 100 years old but we can’t use solutions that are that old by all means:) When you read this you can see the “duping” effect here with just some of the statements “Ramirez noted that she is a big fan of big data”…please…duped and duped again to the most over used lingo out there. Data is data. A few other technologists of late have said the same thing. Now her background is with intelligent property and that’s a whole different arena, did she ever write any code? Probably not but having someone at the FTC who has or who had modeled would be wonderful to bring the real world of non accountability into focus and how models lie and deceive, most playing around with risk, and without it we end up with more “low tech” partial band aid solutions sadly. Again, hired some professional experience quants and let’s get with it as the real world operates today.

Not only myself but many other technologists pounced on the “Reclaim Your Name Campaign” which again fits under the “low tech” band aid topic as that’s what it is. Any technologist will tell you that who knows what they are doing. Again regulation efforts here are futile without establishing an IT infrastructure and path to regulate. I suggest all who sell data should be required to purchase a license and top of that excise tax the banks and companies making windfall profits selling data. Did you see the news yesterday that banks are reaching all time profits? Data selling adds to their bottom line.

FTC “Reclaim Your Name Campaign” Not Good Enough–No Path for Regulation Identified–All Data Sellers Including Banks, Insurers, Etc. Should Be Required to Buy a License

Just yesterday another new venture on selling data with big pharma working with an insurer to sell more data and again what we all worry about is data used against us out of context and we have had years of that with insurance, just read the news for the last few years, all about profit. I really don’t know where some of these folks are coming from to totally ignore or be oblivious of the data selling epidemic that is taking place in the US as it’s now affecting the economy. Why would companies want to lay out capital expenditures when they can mine and sell data with some algorithms out there and put “easy” money to their bottom line with no concern on how it impacts the consumer.

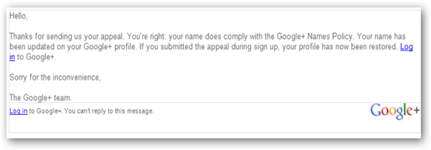

Actually the series of posts I called “The Attack of the Killer Algorithms” covers every day events of this happening and I have had my share. The prior link is actually pretty entertaining as Google’s machine learning identified me as a real duck and cancelled my account with them due to that fact..see how it works…and I had to write to them..I was right so what now, “Duck is not a machine compliant name”? It’s the one I have:) MIT had a hay day with it as again they are technologists and understand how it happened and said “look at a big corporation attacking one little person here:)

Pharma and Health Insurance Companies Pairing Up, Humana’s Analytics Subsidiary and Lilly To Figure Out How to Save (Make) Money and Provide Better Patient Care–Selling Research Data That Competes With FDA Sentinel Initiative

If it sounds like I am frustrated, well I guess I am as when myself and others see what goes on behind the scenes that hurts consumers (me too) and the oblivious government efforts we have seen thus far, it’s scary. We talk about inequality well it is designed that way with powerful math formulas and subsequent algorithms that move and take your money. Cathy O’Neil has done a good job explaining this with her series called “Weapons of Math Destruction” and she was the former Quant at DE Shaw who modeled for Larry Summers. List to the Q and A for the bonus section there and the dangers of him running the Fed. This video was done over a year go so it was in no way prompted by today’s news, it’s reality and how he functions, again that portion for some bonus education and watch “Inside Job” again for more information.

Modeling for Inequality With Segmentation, Insurance Industry Uses Backwards Segmentation As Some Models Stand to Threaten Overall Democracy

The SEC has the same problem with a lawyer at the top of the helm as lawyers are no competition for the thousands of quants and actuaries working at banks, insurers and other companies across the US, the are outdone in a few seconds in the case of market on Wall Street. DOJ, same problem as we saw with the fear of prosecuting a bank, no IT knowledge and DOJ Mann ran for the hills and Frontline documented this very well. It will be interesting to see what this new case of “stolen code” does as you have to laugh as a technologist at the original interpretation admitted by the FBI on “subversion” with the Sergey/Goldman case.

You need an IT Infrastructure to allow any type of regulation here, bottom line and thus so without it privacy help for consumers will go nowhere. It’s hard, I agree for most to embrace what goes on behind the scene with intangibles as you can’t touch, feel or see the algorithms, but they are there making life impacting decisions about all of us. FTC please take note.

Time Has Come to License and Tax the Data Sellers of the Web, Companies, Banks, Social Networks..Any One Making a Profit-Latest Microsoft/Google Privacy War Helping the Cause –Consumers Deserve to Know What Is Being Sold and To Who in a Searchable Format

Use my idea or someone else’s but please stop kidding yourself and this goes for Congress too, get some kind of IT Infrastructure in place that has some “balls” and step up to the plate and help consumers as it’s not getting done present day. BD

Edith Ramirez, the Commissioner of the Federal Trade Commission laid out the case for strong consumer protections regulating the private industry’s use of big data, as the agency asks Congress for the power to level civil fines against businesses for weak consumer data security.

Speaking at the Aspen Forum, Ramirez offered “A view from the lifeguard’s chair,” as her keynote was titled, alluding to her roots in coastal southern California.

“The already intricate data-collection ecosystem is becoming even more complex,” said Ramirez, whose term as commissioner ends in 2015. Ramirez pointed to the “Internet of Things” as a growing technology that will test the bounds of the law.

The FTC, an independent federal agency that turns 100 years old next year, believes it has “an obligation” to protect consumer privacy, said Ramirez. Congress directed the FTC to prevent unfair commercial practices — “conduct that substantially harms consumers, or threatens to substantially harm consumers, which consumers cannot reasonably avoid, and where the harm outweighs the benefits,” said Ramirez, who prior to joining the FTC was a partner in the Los Angeles office of law firm Quinn Emanuel Urquhart & Sullivan, al law firm specializing in intellectual property litigation with clients including Google, Shell Oil, Motorola, Samsung and Sony.

Ramirez noted that she is a big fan of big data. “The fact that decision-by-algorithm may be less than perfect is not to condemn the enterprise. Far from it. Using data-driven analytics to improve decision-making may be an important step forward. After all, human decision-making is not error-free. People often make imperfect decisions for a variety of reasons, including incomplete information, poor decisional tools, or irrational bias. But the built-in imperfections in the decision-by-algorithm process demand transparency, meaningful oversight and procedures to remediate decisions that adversely affect individuals who have been wrongly categorized by correlation. At the very least, companies must ensure that by using big data algorithms they are not accidently classifying people based on categories that society has decided — by law or ethics — not to use, such as race, ethnic background, gender, and sexual orientation.”

http://www.healthcareitnews.com/news/ftc-chief-pledges-tight-reign-data?single-page=true

0 comments :

Post a Comment