Everyone now has made the big change to convert from ICD9 to ICD10 Coding for medical billing. When all of this was taking place, many said it would really not improve care and so far, that’s what we have seen. The big coding change has not any impact in the “real” world; however when it comes to the “virtual” world the impact has been pretty big for analytics with insurance claim data. It was an effort to where doctors and hospitals had to change their billing codes to add thousands of more specific codes. Sure we all laughed at some of the codes and what they represented and some that would rarely be used if at all.

The big sleeping monster on all of this is the use in behavior monitoring with all patients. When fee for service items are billed by doctors and hospitals, this is the first code that is used to determine a diagnosis. The second code is the CPT code which determines what the line item payment will be. The two work together and the US is the only country that has this massive correction between the two for medical providers to get paid. Sure in other countries is may be observed, but in the US, the coding is literally taken to heart everywhere as this is a linear function that doesn’t include the fact that with each patient you have variables, as no two people are the same, so it’s a bit of what I call Quantitated Madness.

providers to get paid. Sure in other countries is may be observed, but in the US, the coding is literally taken to heart everywhere as this is a linear function that doesn’t include the fact that with each patient you have variables, as no two people are the same, so it’s a bit of what I call Quantitated Madness.

Most people have not a clue on how this works, but insurance companies are using “machine” learning technologies to further this linear process, which does become flawed as we do have “variables” with every patient. Now when you visit your doctor and they submit a claim, those claims are being analyzed against machine learning technologies, which I prefer to call “trending” as that’s a much less concerting term if you will. Sure we all learn and gain knowledge by following trends and patterns, but now it’s gone over the top and flawed data is being kicked out to your providers all the time, and in essence it is being used as a platform to push drugs.

Now insurers with their doldrums of “risk” assessing that doesn’t stop, doctors are being graded with these ICD10 numbers included on the claim. If a doctor states that diabetes may not be managed perfectly by the patient with an ICD10 code, they get notes back from the insurance company about “compliance” with analytics that may not be true. In other words, the information that is coming back to them is that they are missing an opportunity to prescribe more drugs, and of course all of this goes into the “magic” formulas they use to “score” our doctors today. If you ever wonder why your doctor is in network today and then gone tomorrow, this analytical scoring of doctors from how they code a medical bill is part of the story. I wrote about that a while back, “The Secret Scoring of America’s Doctors”.

“The Secret Scoring of America’s Physicians” - Algorithmic Math Models For Insurance Network Contractual Exclusions, Relating to MDs Who See Medicare Advantage Patients..

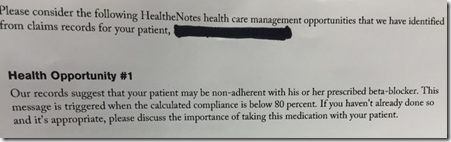

Ok, so you visit your doctor, discuss any chronic conditions and items you need to talk about related to better healthcare. In order for the doctor or hospital to get paid for that service, they bill this information via an ICD10 code that describes the purpose of your visit. Insurance have spent billions of dollars to create system that will take this billing, analyze it and then come back with so called “opportunities” for the doctor to evaluated. I have included a screenshot here from Dr. Wes, who was kind enough to put this on Twitter so you can see what they are bombed with by the time the insurance company does all their expensive analytic processes. In this example, the insurer (United Healthcare) is telling the doctor that the numbers, when crunched say that the patient is not at 80% compliance on taking their medications. Again, this can be totally false as it is all based on a code which can be totally taken out of context. This happens a lot today, not only in healthcare but in other businesses as well and that is how we end up with all these bias analytics.

Insurance have spent billions of dollars to create system that will take this billing, analyze it and then come back with so called “opportunities” for the doctor to evaluated. I have included a screenshot here from Dr. Wes, who was kind enough to put this on Twitter so you can see what they are bombed with by the time the insurance company does all their expensive analytic processes. In this example, the insurer (United Healthcare) is telling the doctor that the numbers, when crunched say that the patient is not at 80% compliance on taking their medications. Again, this can be totally false as it is all based on a code which can be totally taken out of context. This happens a lot today, not only in healthcare but in other businesses as well and that is how we end up with all these bias analytics.

Pay attention is this is the type of analytics that is being created about all of us and in this example, you can see, it’s clearly promoting a pharma agenda and of course we know United Healthcare has a big interest in this as OptumRX is their number one dollar producting revenue stream, more than Medicare Part D and their two other reporting groups. Here’s what I wrote about the United first quarter and the second quarter was the same story with where the big money was coming in for 2016.

United Healthcare Reports 1st Quarter-OptumRX (Pharmacy Benefit Manager) Produces More Revenue Than Its Health Insurance Groups

The company has clearly made a change in their operation to focus on partnering with big pharma to profit as a priority. If you were not aware, that is how United Healthcare got started in business in the 70s as the first pharmacy benefit manager in healthcare. They later sold the company to a drug company and used the sale profits to buy insurance companies and began as a healthcare insurance company.  A couple years later, Express Scripts bought the company from the pharmaceutical firm and so Express Scripts was able to get all the magical analytics code that runs today, with even more compleities added. Outside of this blog, many times over United Healthcare has been covered by many other articles that talk about the millions or billions the company makes selling your data as well.

A couple years later, Express Scripts bought the company from the pharmaceutical firm and so Express Scripts was able to get all the magical analytics code that runs today, with even more compleities added. Outside of this blog, many times over United Healthcare has been covered by many other articles that talk about the millions or billions the company makes selling your data as well.

United Healthcare Reports 1st Quarter-OptumRX (Pharmacy Benefit Manager) Produces More Revenue Than Its Health Insurance Groups

So when you look back on this big push for ICD10 conversion, it has not done anything to provide better care for patients with doctors, but in reality added another level of complexity so you could be further “scored” and “risk assessed” by insurance and drug companies. Again, with using linear measurement standards you end up somewhat being “scored” or “graded” on this so called curve of machine learning, which may not represent your entire health picture at all but ends up being more flawed data that doctors have to deal with and an analytics platform to push more drugs. From the consumer side, you are “scored” on what the Pharmacy Benefit Managers “predict” you adherence and compliance will be. Read the link below to find out about the 300 metrics used, that actually Express Scripts bragged about that are proprietary and hide the bias, all for the sake of creating these flawed scores relative to your behavior.

Medication Adherence Predictions Enter the World of Quantitated Justifications For Things That Are Just Not True, Members of the Proprietary “Code Hosing” Clubs Out There Destroying Your Privacy

Here’s a link from the archives that tell about Express Scripts buying those “Ingenix” algorithms to score consumers on medication adherence and this was the root of it as PBMs went over the top with their “flawed prediction” software.

Express Scripts- New Program to Contact and Predict Patients Who May Not Be Taking Their Medicine Based On IngenixAlgorithms–We Want the Revenue Please Don’t Stop

This further graduates to the retail pharmacists who fill our prescriptions and how they are graded on their pay for performance levels on how you are predicted to take your meds. Sure this is always a work in progress chore and pharmacists over all do a good job, and the patient may be well in compliance but they worry too about this flawed data that “scores” them. You read the link below and watch the videos on the threatening letters they receive if they give you a cash price that is less than your insurance co-pay is. In other words, they get penalized for helping the consumer with price if it is not what the insurance company supplies. Why? They can’t track the data as efficiently if you pay cash.

The Truth About Pharmacy Benefit Managers and Prescription Discount Cards–Created With Automated Algorithmic Processes That Enable Huge Profits-Consumers at Risk!

By the way, you cannot even get this “medication adherence prediction” score that is calculated about you from your “data” behavior as it is secret. So you have two sides of this flawed at work, from the doctor side and from the pharmacy side with insurers beating both over the head with wanting them to further control your behavior. We all know that one person can’t control another person, but this is the perception-deception being sold out there. Education is still the best method and to rate and grade patients on flawed data analytics is just wrong and fraudulent.

So there you have it, the big ICD10 change was not to provide better care for patients and has not done one thing to improve that as you can read the news every day, we are all paying for additional flawed analytics that go nowhere except into the profits of insurers and pharmacy benefit managers with perceptions of the data taken out of context and skewed to make everyone look worse than they are.

All of this analytics work with claim data about you of course is all sold and CMS Slavitt (an Algo man, former Goldman banker and McKinsey consultant) is all over it with wanting  to sell all this claim data as well so more companies can create even more flawed analytic scores about you so more software companies can jump into the “Code Hosing” game. Read more about that at the links below.

to sell all this claim data as well so more companies can create even more flawed analytic scores about you so more software companies can jump into the “Code Hosing” game. Read more about that at the links below.

CMS Chasing Wild Virtual Horses-A Big Distraction on the Hope of Finding Some “Algo Fairies” By Giving Entrepreneurs Access to Medicare Claims and Other Data…Marketing & Astro Turfing “The Sebelius Syndrome”..

CMS Medicare Proposing More Data Selling of Both Private and Medicare Patient Claim Data - A New Dignity And Privacy Attack on Both Consumers and Doctors

So the cat is out of the bag, ICD10 was a new avenue for analytics in healthcare and does not one thing to produce better care, but was rather one more form of Health IT software that all were required by law to invest in. So a little satire, here, why even as a consumer even get out of bed in the morning…you’re already risk assessed to the hilt! We have no value when you look at all this nonsense and we all seem to be a risk to the world anymore. What happens next on Infusion compliance? As you can see insurers are buying those companies up as well. Will each vein be risk assessed next? There’s a ton of cronyism at the link below as well to include a discussion on Loretta Lynch as one example being a former lawyer who represented United Healthcare with anti trust lawsuits so you can see she’s in on the game or the dupe, one of the two. BD

0 comments :

Post a Comment