This is a pretty interesting lawsuit and it includes named invidituals at HHS and CMS as well as participants. You can view all the defendants included in the filing here. Being we are at the end of the Obama administration, the named directors Burwell and Slavitt in this case involvement once out of office may or may not still be included, but OptumRX portion looks like it won’t go away.

This is basically collusion with the government giving exceptional regulation controls to OptumRX on  the accredited distribution of drugs distribution of drugs in the US with basically setting up shop with only the 3 major distributors, and thus so it is making it harder for the secondary or smaller drug distributors to function and operate. We know what less competition probably means, even higher prices at the drug store.

the accredited distribution of drugs distribution of drugs in the US with basically setting up shop with only the 3 major distributors, and thus so it is making it harder for the secondary or smaller drug distributors to function and operate. We know what less competition probably means, even higher prices at the drug store.

The lawsuit also points out that United Healthcare is a Medicare Part D insurer and with that fact it appears to be an “agent of the government” will also having the OptumRX subsidiary, the PBM manager having the authority to use the accrediting program called VAWD to basically let other smaller drug distributors in the game. It would seem to make more sense to have pharmacies be accredited than distributors since they are the ones selling the drugs.

OptumRX might be working to drive independent pharmacies out of business to and convert those customers to their mail order pharmacy or to Walgreens, their preferred pharmacy partner. Recently there was a big partnership created there as well to allow higher profits via Walgreens.

Walgreens Signs Agreement With PBM OptumRX (United Heatlhcare) and Anthem Then Sues Express Scripts

The fear is that secondary drug distributors will be pushed out of business. Effective October 1st, all prescription claims not not filled via a VAWD distributor could be denied. There’s a long list of VAWD credited distributors. Wholesalers in most states are already subject to inspection by state and/or federal regulators to ensure compliance so what’s the action with OptumRX to act as a 3rd party regulator of sorts? All pharmacies who fill prescriptions are required to sign a contract with Optum, which I have read in some instances includes the pharmacists not being able to offer a cheaper cash price to the customer as they would be in violation of the contract.

Here’s an interesting tidbit on how OptumRX makes a ton of money from diabetes test strips, take notice of this and the entire article can be read here. Look at how this winds around with insurer United making big deals on test strips, but does this savings get passed on to the consumers, apparently not.

“Tackling OTC supplies was the logical next step for OptumRX. OptumRX has a booming mail-order pharmacy business and diabetic test strips play a big role in their profitability. They champion one brand, Roche’s Accu-Chek, and by pooling their purchasing power get manufacturers to compete against each they secure steep discounts. To put this in real world terms: from a retail pharmacy, these test strips cost about $90 per 50 test strips to the consumer and is then adjudicated with insurance companies for about $95. However, with their steep discounts, it is estimated that OptumRX pays only about $10 per box of 50 test strips because Roche only charges Medicare about $5 for that same box.

This means that OptumRX stands to make up to $85 in gross profit per box, per month; multiplied by the diabetic population of their 65 million members, OptumRX is playing with real numbers. It sheds a lot of light onto American’s high insurance premiums and the resources they can call on to fight the legal action brought against their new bold policies in court.”

If noting else, when you look at the big money that the OptumRX subsidiary of United is making, the paragraphs above shed some light on how this is happening and it’s all done with algorithmic business models with a series of algorithms for distributors and drug stores to jump through.

United Healthcare Reports 1st Quarter-OptumRX (Pharmacy Benefit Manager) Produces More Revenue Than Its Health Insurance Groups

Again states have regulations but now OptumRX in fact is becoming a 3PL regulation enforcer via the government on some of this? I have read that OptumRX is giving folks some extended time to become VAWD certified before cancelling payments here and there, and wholesalers must already comply with the Drug Supply Chain Security Act (DSCSA) which requires the FDA to issue regulations regarding wholesale distributor and third-party logistics provider licensure.

So basically smaller distributors who provide better drug prices might be edged out completely. So again with more certification policies and adherence, is this going to fix any

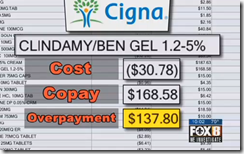

thing other than to allow OptumRX to charge more a the drug store counter and really accomplishe much? Here’s the lawsuit on the “clawbacks” that are taking place when you arrive to get your prescription at the drug store with the OptumRX algorithms “front running” the script cost via the pharmacy software networks in place all over the US before you can physically even get there to fill your prescription too.

Cigna & United Healthcare Face Class Action Suits-PBM Over Charging Customers for Prescriptions, OptumRX Pharmacy Benefit Management Software-“Front Running” Consumers With Killer Algorithms at the Drug Store

I’ve often said it would be of real interest to have a video of a pharmacist filling a prescription via the software of the pharmacy benefit management systems in place at pharmacies today so the public can see what the process is for the pharmacist just to get you your bottle of pills, and maybe involving a call or two to the dreaded PBM pharmacy tech.

Don’t forget that Optum 360 is now taking care of all your Quest Diagnositics lab bills too as their outsourcer. Pay attention to the “too big to fail” health insurer, United with close to 300 subsidiaires that do all kinds of things out there outside of just insurance. BD

Quants of Optum Carve Out New Outsourced Billing Deal with Quest Labs, Will Also Serve to Enhance The Scoring & Data Selling Business Conducted by Both Companies via Powerful Subsidiaries

They’re buying up your doctors too, another reason you can’t keep your doctor as they own and manage physicians groups all over the US today.

OptumCare Doctors to Get Allscripts Medical Records EHR–Optum Continues to Buy More Practices and Manage More Doctors Through Independent Physician Associations, Many of Which They Own

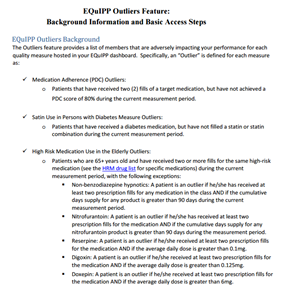

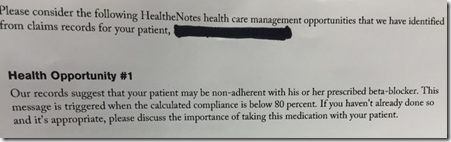

By thew way, if you have never seen how the automated prescription services work, take a look at this…complete audit trails that also feed medication compliance software data systems. That is yet another topic for conversation with flawed data using metrics about us that are flawed. BD

WASHINGTON (Legal Newsline) - A not-for-profit trade association that represents independently-owned pharmaceutical wholesalers is suing a pharmacy benefit manager and the federal government over a new accreditation policy, arguing it violates various state and federal laws. The Association of Independent Pharmaceutical Wholesalers Inc., based in Pine Brook, N.J., filed its complaint in the U.S. District Court for the District of Columbia Nov. 4.

The named defendants include OptumRx Inc., based in Irvine, Calif.; the U.S. Department of Health and Human Services; Sylvia Burwell, secretary of the DHHS; the Centers for Medicare and Medicaid Services; and Andrew Slavitt, acting administrator of the CMS.

“OptumRx’s business relationships with the Big Three have resulted in the implementation of bad faith policies designed to steer market share away from the Secondary Wholesale Market and toward the Big Three,” AIPW alleges.

For instance, AIPW claims OptumRx, in August, informed its participating pharmacies that effective Oct. 1, participating pharmacies were required to purchase all medications being dispensed to OptumRx members from a VAWD. VAWD, an accreditation offered by the National Association Boards of Pharmacy, essentially eliminates the secondary wholesale market, AIPW argues.

“Plaintiff’s members have already been informed by their pharmacy customers that the pharmacies will cease ordering medications and supplies from Plaintiff’s members due to OptumRx’s VAWD-Accreditation Policy,” the association alleges. “This is because the pharmacy customers face PBM audits from OptumRx, whereby OptumRx actively threatens to ‘recoup’ 100 percent of funds paid to the pharmacy arising from the purchase of drugs from wholesalers such as Plaintiff’s members that are not VAWD accredited.”

PBM management company, both front running consumers at the pharmacy counter. I always tell people, pay attention to what’s going on with the subsidiaries of big insurers and follow the data algorithms to really see what’s going on out there today as you see very little mention in major news today as insurers are some of their biggest advertisers, so we know what that means…

PBM management company, both front running consumers at the pharmacy counter. I always tell people, pay attention to what’s going on with the subsidiaries of big insurers and follow the data algorithms to really see what’s going on out there today as you see very little mention in major news today as insurers are some of their biggest advertisers, so we know what that means…

or medical conditions for underwriters.

or medical conditions for underwriters.

clue on what it could have entailed but again one could ask would such behavioral analytics serve a purpose to make one doubt themselves even further? It could if the therapie were tweaked the wrong way.

clue on what it could have entailed but again one could ask would such behavioral analytics serve a purpose to make one doubt themselves even further? It could if the therapie were tweaked the wrong way.

A couple years later, Express Scripts bought the company from the pharmaceutical firm and so Express Scripts was able to get all the magical analytics code that runs today, with even more compleities added. Outside of this blog, many times over United Healthcare has been covered by many other articles that talk about the millions or billions the company makes selling your data as well.

A couple years later, Express Scripts bought the company from the pharmaceutical firm and so Express Scripts was able to get all the magical analytics code that runs today, with even more compleities added. Outside of this blog, many times over United Healthcare has been covered by many other articles that talk about the millions or billions the company makes selling your data as well.  to sell all this claim data as well so more companies can create even more flawed analytic scores about you so more software companies can jump into the “Code Hosing” game. Read more about that at the links below.

to sell all this claim data as well so more companies can create even more flawed analytic scores about you so more software companies can jump into the “Code Hosing” game. Read more about that at the links below.