Here we go again. If you haven’t figured this out yet, when you buy a Cigna Health insurance policy you get a two for one with 2 insurers. Cigna provides the insurance benefits and then it’s pharmacy benefit manager, PBM OptumRX (biggest revenue sector subsidiary of United Healthcare) that runs all their formulas via the computer and tells the pharmacist what to charge you. (Video at the break below-watch it!)

If You Are Insured byCigna, Guess What You Have a New Pharmacy Benefit Manager Named United Healthcare

I call this “front running” the consumer at the prescription counter if you will, as that’s a term we hear used in stock trading all the time and it’s somewhat a very similar model with providing the drug stores advance information before you can even physically get there to ask for a cash price from the pharmacist. Markets work the same way with dealing on advance information provided by their brokers and investment analysts, before their clients get a chance to see it. Less than a month ago, United Healthcare received the same type of lawsuit for doing the same thing. Below are a couple links with some videos that explain how this works in the words of the pharmacists.

from the pharmacist. Markets work the same way with dealing on advance information provided by their brokers and investment analysts, before their clients get a chance to see it. Less than a month ago, United Healthcare received the same type of lawsuit for doing the same thing. Below are a couple links with some videos that explain how this works in the words of the pharmacists.

The Truth About Pharmacy Benefit Managers and Prescription Discount Cards–Created With Automated Algorithmic Processes That Enable Huge Profits-Consumers at Risk!

Be Aware of Prescription “Claw Backs” as Pharmacy Benefit Management Profit Centers Continue to Evolve

In my own observations, Cigna is kind of living under the thumb of United Healthcare right now anyway and if I were them I would not be too happy having a competitor meddling in various areas of customer data that probably goes beyond prescriptions as United is the second largest healthcare data seller out there, behind IMS.

Cigna Launches New Company, CareAllies To Manage Patient Care, Doing Same Things as Does Optum

Actually the data selling algorithms provided mostly by United Healthcare/OptumInsights even goes beyond prescriptions and such algorithms were sold to a subsidiary of Quest Diagnostics called Exam One and they use the same formulas to score you and sell that data as well. Also, in case you missed it, United Healthcare will be preparing your Quest Labs bill as well. Another United Healthcare company, Optum 360, to which Dignity Healthcare is a partner will be doing their billing for them. Over 2000 Quest employees were let loose and rehired under the Optum 360 name, and we kind of all know what that represents for the employees with reductions in pay, benefits, etc. in order to save money as that’s why they outsource.

Quants of Optum Carve Out New Outsourced Billing Deal with Quest Labs, Will Also Serve to Enhance The Scoring & Data Selling Business Conducted by Both Companies via Powerful Subsidiaries

So how did this marriage occur? United Healthcare under their “Optum” subsidiary bought a pharmacy benefit management company named Catamaran, who was the exclusive PBM (pharmacy benefit manager) for Cigna. In addition, Catamaran was in a bit of hot water and partially responsible for getting Cigna sanctioned by CMS with denying drugs and access to care. Cigna was around 2 years into a 10 year contract with Catamaran and I assume that was a big lure for United Healthcare as with buying the PBM, they increased their OptumRX revenue by around 25% and there were about 8 years left on this agreement. This sanction has been in place since January of this year (seems like a long time) and none other than former United Healthcare Executive CMS Andy Slavitt makes the call on when to allow Cigna to sell Medicare D policies again. If you look at how this all came about and the competition with health insurers, it certainly gives the appearance that CMS Slavitt could very well be making sure his former employer, United Healthcare benefits.

Remember that HHS Secretary Burwell was able to provide pardons for Slavitt (so he could do his job, the reason) to discuss policy and healthcare business with United (to include the CEO) any time he wants, so who knows how often the two might get together for lunch and chew some healthcare policy and some fat. Here’s the story on the sanctions levied against Cigna in January of this year.

CMS Sanctions Cigna-No More Selling Any New Medicare Advantage Policies Until Algo Problems Denying Medical Coverage and Prescription Denials Are Fixed

Cigna is also still saddled with yet another Ingenix lawsuit that has not completed and that goes back to the days when CMS Andy Slavitt as CEO of Ingenix was caught using algorithmic formulas to short pay doctors on out of network payments. This was discovered by Andrew Cuomo and there were multiple class action lawsuits filed, including the big case from the AMA on the fraudulent activity in 2010.

Cigna Legal Case With Ingenix Flawed Formulas for Out of Network Payments Allowed to Proceed Under ERISA, Can’t Avoid the Claims…

United Healthcare had a $10.5 Billion dollar bond sale to acquire Catamaran PBM and wrap into OptumRX in record time with importing customers. It was well stated all over the web outside of this blog that both companies were using “like” technologies so the process would be quick and easy. Being a former developer and what I have seen over the years, there’s probably a good chance that Catamaran was licensing the old Ingenix or OptumInsights algorithms, as all the pharmacy benefit management software seems to come back to that being the tech or algorithms being used. It’s not uncommon as for another example you have Cerner as a reseller of Ingenix/Optum Revenue Cycling technologies with their medical records systems. The link below gives you more information on the acquisiton of the Cigna Catamaran PBM by United Healthcare/Optum.

United Healthcare Buys Catamaran Pharmacy Benefit Manager Just As the PBM Gets Hit With A Class Action Lawsuit For Low Balling Pharmacy Reimbursements..And More Patient Data to Sell and Analyze For Profit

In addition last year United is getting into the workman’s comp area of pharmacy benefit management with buying Helios and the largest customer serviced by Helios is the US Post Office.

United Healthcare Buys Helios Workman’s Comp PBM and Their Other Related Businesses

The link at the bottom of this page from the story reported (the source) has copies of the actual court documents filed against Cigna and United Healthcare and it’s called racketeering. Be sure and check it out. Most all the links in this post are prior posts from the Medical Quant that give you additional information relative to what’s going on. Pharmacists are being told to not disclose the cash price unless you ask so be sure to ask.

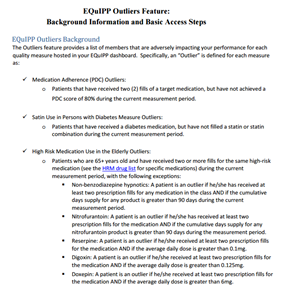

Pharmacists in this whole scheme are also required to use software to input data so PBMs can produce a predictive secret score, than can also be sold to predict if you will take your meds. Read up on that one as well. Most consumers have no clue they are being secretly scored with software that does produce flawed and bias data every time you fill a prescription. One of the programs is called EQUIPP and recently Rite-Aid has rolled out this software to their drug stores and current users include Wal-Mart and more.

than can also be sold to predict if you will take your meds. Read up on that one as well. Most consumers have no clue they are being secretly scored with software that does produce flawed and bias data every time you fill a prescription. One of the programs is called EQUIPP and recently Rite-Aid has rolled out this software to their drug stores and current users include Wal-Mart and more.

Rite Aid Pharmacies are the Latest to Begin Used Flawed Data Provided by the EQuIPP Platform Relative to “Scoring” Patients for Predictive Medication Adherence–The “Outlier” Patients…

Medication Adherence Predictions Enter the World of Quantitated Justifications For Things That Are Just Not True, Members of the Proprietary “Code Hosing” Clubs Out There Destroying Your Privacy

Do pay cash when you can at the drug store for your own privacy benefits when you can, even though you risk being coded at an Outlier by the software, it’s less other data that can get linked to you.

Patients Who Pay “Cash” When Filling Prescriptions Are Now Called “Outliers, Pharmacists Required to FixOutliers as They Show Up As Non Medication Adherence Compliant With 5 Star Systems Full of Flawed Data…

You can click on the image to read a short screenshot on what they do and if you as a patient are not in the 80% percentile, your pharmacist is required to hammer you to bring their numbers up so they can meet their goals and sometimes even keep their jobs, as the culling effect on pharmacist performance is out there as well as what doctors put up with today. If you are a diabetic and your pharmacy uses the EQUIPP program, the pharmacists are required to hit you up to tell you to ask your doctor about statins so more drugs can be sold. Of course this is where the pharma business comes into play here as well to boost their sales.

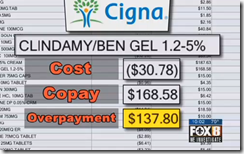

It’s to the point now where there are way too many consumers getting hit with the “co-pay” algorithms of the pharmacy benefit managers and the health insurers, so lawsuits have been filed. As a matter of fact the pharmacy benefit management business is so profitable it’s the #1 revenue stream for United Healthcare, ahead of their insurance groups and we’ll see if Q3 is yet another barn burner for them with PBM revenue. OptumRX also just secured a 5 year contract with CALpers to manage all of their drug programs worth about $5 billion.

United Healthcare Reports 1st Quarter-OptumRX (Pharmacy Benefit Manager) Produces More Revenue Than Its Health Insurance Groups

There seems to be some rotten algorithmic eggs out there slinking around in the pharmacy benefit management business and they all do it to some degree but some are much worse than others. With the recent CMS 5 Star ratings of Medicare D insurers, it’s starting to stink over there too. CMS has been running models created by United Healthcare for years and now some of them are either failed in concept creation or are failing as time are failing. Humana is now being hit with a loss of CMS money for not providing “quality” care. We all know these surveys CMS uses are a joke and now the algorithms compiling all of this are at the point to where they are hurting the stock of Humana and Cigna, who again is sitting under the thumb of United Healthcare with the PBM OptumRX.

If I were Humana, and this is just me speaking I would consider suing CMS and Slavitt on this point, and Humana has already put out a press release contesting the 5 Star ratings. What you are seeing here is a diminish of available insurance for consumers, using flawed and evil algorithms  with United flexing their power where they can to gain an edge. It’s getting to be pretty visible if you look as that’s how they grew their business, math and algorithms. Watch the 4 videos in the footer of this blog to understand how this works as there’s not a ton of difference between some financial models and tweaked health insurance models today. I saw this evolving way back in 2009, but it takes a while for more to clue in, I get that.

with United flexing their power where they can to gain an edge. It’s getting to be pretty visible if you look as that’s how they grew their business, math and algorithms. Watch the 4 videos in the footer of this blog to understand how this works as there’s not a ton of difference between some financial models and tweaked health insurance models today. I saw this evolving way back in 2009, but it takes a while for more to clue in, I get that.

The incest of United Healthcare with HHS/CMS began years ago when Lois Quam, a former big VP at United Healthcare took a leave of absence from United and worked at the White House as the senior advisor to Hillary when “Hillarycare” was created. You can also see a lot of this incest over at the John Postesta created CAP (Center for American Progress) with several former and current United Healthcare executives as “fellows”, some even earning the name of a distinguished fellow. Currently former Senator Tom Daschle, a big lobbyist for Aetna is one of the CAP’s distingushed members, along with others such as Larry Summers as with their financial interests. Zeke Emanuel and Jonathon Gruber can also be found at the CAP, writing US Healthcare policy as contributors.

HHS Joins Optum Labs as Research Partner–Back Peddles Support of FDA Sentinel Program That Does the Same Thing-More Impact from the Six Degrees of Bob Rubin Running Healthcare in the US

Here’s another good read written by a former CMS analyst and Tillman pretty much lines up every player in the ACA and their connections to United Healthcare along with their actions in turning healthcare in the US in to a “Cottage Industry”. I would guess she should know after many years spent on the inside track involved in ACA policy. It’s along read but worth it.

Building the Infrastructure of the Affordable Care Act: Hillary Clinton, UnitedHealth Group/ Optum, and the Center for American Progress

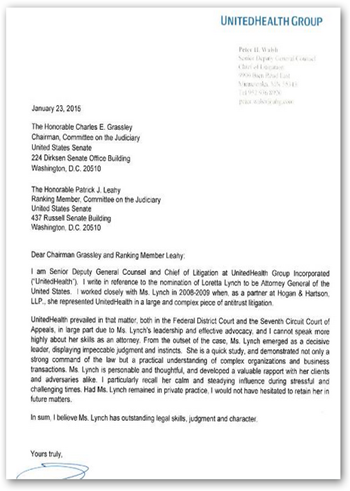

Good luck getting any real anti-trust action going here as our head of the Department of Justice is also a former United Healthcare anti-trust lawyer during the time she worked at Hogan Lovells (current lawfirm name). If you  look over there you will find a few former Untied Healthcare lawyers working there today, including the one who wrote this letter of recommendation to Grassley to approve her nomination. In addition with the expansion of the large number of urgent care clinics that United/Optum has opened or purchased (MedExpress) they have even more outlets to push their OptumRX pharmacy benefits to patients to gain more revenue.

look over there you will find a few former Untied Healthcare lawyers working there today, including the one who wrote this letter of recommendation to Grassley to approve her nomination. In addition with the expansion of the large number of urgent care clinics that United/Optum has opened or purchased (MedExpress) they have even more outlets to push their OptumRX pharmacy benefits to patients to gain more revenue.

Optum Clinics Holdings, New Subsidiary Incorporated In 2015 Raises Over 36 Million (Exchange of Shares) From Investors Unknown-Form D Used to Maintain Secrecy Of Who They Are For Now…

OptumCare Doctors to Get Allscripts Medical Records EHR–Optum Continues to Buy More Practices and Manage More Doctors Through Independent Physician Associations, Many of Which They Own

So here we have it, two insurers, Cigna and United Healthcare both using the same OptumRX (owned by United Healthcare)  PBM management company, both front running consumers at the pharmacy counter. I always tell people, pay attention to what’s going on with the subsidiaries of big insurers and follow the data algorithms to really see what’s going on out there today as you see very little mention in major news today as insurers are some of their biggest advertisers, so we know what that means…news rigging (grin). Don’t think because you fill your prescription at Walgreens that the OptumRX data is not there on the pharmacist’s computer, as it is, they are connected everywhere.

PBM management company, both front running consumers at the pharmacy counter. I always tell people, pay attention to what’s going on with the subsidiaries of big insurers and follow the data algorithms to really see what’s going on out there today as you see very little mention in major news today as insurers are some of their biggest advertisers, so we know what that means…news rigging (grin). Don’t think because you fill your prescription at Walgreens that the OptumRX data is not there on the pharmacist’s computer, as it is, they are connected everywhere.

Walgreens Signs Agreement With PBMOptumRX (United Heatlhcare) and Anthem Then Sues Express Scripts

It doesn’t stop there either as “co-pays are in your veins” too with CVS buying Omni-Care and OptumRX with buying AxelaCare.

OptumRX (United Healthcare) Buys Home Infusion Company AxelaCare-Using Algorithms To Determine Your Care With Being Financed By A “Too Big to Fail” US Health Insurance Company…

CVS Buys Omnicare–Selling Drugs to the Elderly Via Nursing Homes and Assisted Living Homes And Pays Over $2 Million Dollar Fine In California for False Advertising

Here’s another trick that is used to get more co-pay money from you from CVS.

CVS To Charge Consumers Higher Co-Pays With Prescriptions Filled at Drug Stores That Still Sell Tobacco Products–Killer Algorithms Attacking Once Again To Make SureCVS Gets the Prescription Revenue And Your Data To Score And Sell

The data selling and predictive flawed modeling scores in healthcare and pharmacies needs an over haul indeed as today, it’s once again the consumer having to stay one step ahead of the “front running” of drug prices out there with the PBM algorithms that are there to test you and get more money from you every step of the way.

We just want fair drug prices and a stop to the “tricky front running killer algorithms” that soak us for more money when we fill our prescriptions!

Be sure and ask your pharmacist every time for the “cash” price and circumvent some of algo duping taking place out there today for profit. BD

FOX 8 WVUE New Orleans News, Weather, Sports, Social A spreadsheet given to FOX 8 News by a pharmacist in the Midwest shows Cigna Health Insurance overcharged at least 70 customers for prescription medication in one month, at just one community pharmacy. The spreadsheet details how the insurance company paid the pharmacist $25 for an acne cream. But Cigna instructed the pharmacist to collect a $187 copay, overcharging the customer $167. That money went right back to Cigna.

"One of the claims that we brought in the case is a RICO case, a racketeering case," says plaintiffs' attorney Craig Raabe. "And part of the racketeering case is a scheme to defraud - essentially an entity is engaging in fraud use through interstate commerce. And that creates the racketeering. So, it's a term of art in what we do, but in common sense terms it's fraud - saying one thing and doing another." A Massachusetts woman filed the class action lawsuit against Cigna at a federal court in Connecticut, where Cigna's corporate headquarters is based.

I work for OptumRx (at a contract facility) and it is a fraud factory!!! I will not use my UHC insurance benefit to fill any of my rxs b/c it costs too much and with the high deductible, I must pay an outrageous full cost of the rxs before I can pay an OVER PRICED copay. If anyone wants to talk with me, contact FBI agents I have worked with in the past named, Hartmann or Hassman (they are/were partners) and they will contact me.

ReplyDelete