There has to be a way to keep shareholder interesting rolling right? What makes this story interesting is the fact that other insurers are already covering the device and United, who preaches preventional medicine doesn’t seem to be in line with what most of what they write today? You can read the article below on how algorithmic decisions on expenses are weighing heavily on what decisions they make. What makes this device unique is the fact that it monitors dropping sugar levels and that’s a big deal for those with diabetes too. As I commented below, is this move one for keeping more money available for stock buy backs?

with what most of what they write today? You can read the article below on how algorithmic decisions on expenses are weighing heavily on what decisions they make. What makes this device unique is the fact that it monitors dropping sugar levels and that’s a big deal for those with diabetes too. As I commented below, is this move one for keeping more money available for stock buy backs?

United Healthcare To Now Require Prior Approval on Non Vaginal Hysterectomy Procedures–Laparoscopic Power Morcellator Controversy Fueled the Fire And Now More Savings To Facilitate Bigger Stock Buy Backs?

The video here discusses how the device costs $10,000 for the patient to buy on her own. Ok that is the “stock” price and we all know that insurers via purchasing associations and hospitals do not pay that price, so overlook that in the video if you will as far as being what the insurer, United would pay. Look at this from last year in New York, United has no problem kicking out a huge check for a $175,000 hammer to procedures that normally runs between $10-20k as an average.

$175,098.80 To Fix A Hammer Toe Billed by New York Podiatrist And the Insurer Paid It, Well Sort Of As They Sent the Check to the Patient By Accident, A New Investigation For “Out of Network” Charges Has Resulted

Well let’s take one more look at a similar case in California with lap bands and this one is very interesting for sure as the corporate lawyer in their defense seems to be totally unaware that United sells and markets anti fraud software and has for years, so even their own lawyers don’t understand the armies of subsidiary companies that United runs.

interesting for sure as the corporate lawyer in their defense seems to be totally unaware that United sells and markets anti fraud software and has for years, so even their own lawyers don’t understand the armies of subsidiary companies that United runs.

Lap Band Surgeries Go Full Circle With Lawsuits–Now United Who’s Being Sued, Files Case Against Company Who Provided the Advertising and Services

Again I look at the entire company as a whole and look at what each subsidiary does and United has a big stock buy back program going on as well as a dividend offering to shareholders so don’t let this side of the business decisions pass you up as it does have impact. Al the major insurers are listed on the S and P 500 and recently Bloomberg came out with an article that said 95% of the profits made by S and P 500 companies were going back into stock buy backs…so you put the two together here ok? Don’t’ be naïve on some of the decision making as there’s 2 sides to every story.

Insurance Carrier Stock Buy Backs Continue to Rise While Consumers Are Finding It Harder to Afford Some Policies and Care With Dealing With High Deductibles And Narrow Networks…

So as it goes different insurers can make different decisions, so according to this story, United has not deemed this device to be a covered device and perhaps a purchasing organization will come in to play here as again we know insurers do not pay “stock prices”. BD

A suburban mother living with Type 1 Diabetes said she is being denied a potentially life-saving medical device by her insurance provider.

Amy Carbone of Palos Heights said she also has hypoglycemia unawareness, a complication of diabetes in which the patient is unaware of a deep drop in blood sugar levels. She said her condition makes her more susceptible to losing consciousness.

That’s why Carbone’s nurse practitioner prescribed her a new device called the Medtronic MiniMed 530G with Enlite. It includes an insulin pump and a continuous glucose monitoring system. The device shuts off when blood sugar gets low.

“I’ve got other patients who are on this device who said it’s a God-send because without it they would have no idea that their sugars were dropping,” said Terese Bertucci, APN.

Carbone’s insurance provider, United HealthCare, will not cover the device for her. The company sent a denial letter to Carbone which read the services “are not eligible for coverage because your plan does not cover unproven procedures.” The letter also stated “current medical studies have not shown that this device is equal to or better than other standard pumps” for Carbone’s condition.

The FDA-approved MiniMed 530G with Enlite is listed online at a cost of more than $10,000. The device also requires constant supplies. But other insurance companies, including Aetna, Cigna, Humana and Blue Cross/Blue Shield, told NBC 5 Investigates they would cover the device for members who meet their criteria.

the network for some of their insured, mostly those who buy a policy from an insurance exchange, where United pays the doctors somewhere between Medicaid and Medicare rates.

the network for some of their insured, mostly those who buy a policy from an insurance exchange, where United pays the doctors somewhere between Medicaid and Medicare rates.  with our perceptions here and are back living the “Sebelius Syndrome” of whacked out perceptions again.

with our perceptions here and are back living the “Sebelius Syndrome” of whacked out perceptions again.  watch video #2 if you want to read up and get introduced to the world of Killer Algorithms out there. Mr. Derman gets it and I agree, why we have all these broken models and people that can’t work with them…

watch video #2 if you want to read up and get introduced to the world of Killer Algorithms out there. Mr. Derman gets it and I agree, why we have all these broken models and people that can’t work with them… similar and how we can’t run through markets as humans like data does with stock exchanges. They do try to use some of those financial elements but we hit the wall when we can’t change doctors, plans, and everything else they put in the model in a time frame that suits profits for share holders.

similar and how we can’t run through markets as humans like data does with stock exchanges. They do try to use some of those financial elements but we hit the wall when we can’t change doctors, plans, and everything else they put in the model in a time frame that suits profits for share holders.

The big issue here is questioning the accuracy of the readings for the first issue with the app. We all know how we need the blood pressure cuff to get an accurate reading and there are numerous types of home units you can buy versus this app on the phones.

The big issue here is questioning the accuracy of the readings for the first issue with the app. We all know how we need the blood pressure cuff to get an accurate reading and there are numerous types of home units you can buy versus this app on the phones.  or any type of study that backed up their claims, stating they were creating proprietary algorithms. They kept mentioning they would “soon release data” that showed how the app worked, but more than eight months later they still haven’t released any studies or proof showing how the app works.

or any type of study that backed up their claims, stating they were creating proprietary algorithms. They kept mentioning they would “soon release data” that showed how the app worked, but more than eight months later they still haven’t released any studies or proof showing how the app works.

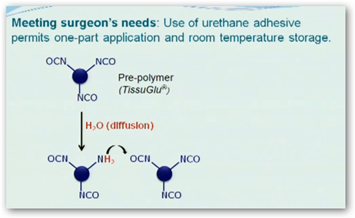

alternative to closed-suction drains in large flap procedures such as abdominoplasty. In the pivotal clinical trial, when TissuGlu was used, patients required fewer post-operative treatments and resumed normal activities, such as going to work, showering and using the stairs, more quickly.

alternative to closed-suction drains in large flap procedures such as abdominoplasty. In the pivotal clinical trial, when TissuGlu was used, patients required fewer post-operative treatments and resumed normal activities, such as going to work, showering and using the stairs, more quickly. attention too is the types of lists contained here and there’s no reference to some of the origins. This means that more than likely the data has been repackaged and re-queried with other data. When the Anthem breach news broke, again I took the opportunity to mention again that crooks want to sell data too.

attention too is the types of lists contained here and there’s no reference to some of the origins. This means that more than likely the data has been repackaged and re-queried with other data. When the Anthem breach news broke, again I took the opportunity to mention again that crooks want to sell data too.

Read the link below to see where banks, insurers and the CFPB are all buying up your credit card transactions. This is a daily thing by the way, depending on the contract with how much data Argus will provide. They do analytics and thus you end up with another one of those “secret scores” on your record somewhere.

Read the link below to see where banks, insurers and the CFPB are all buying up your credit card transactions. This is a daily thing by the way, depending on the contract with how much data Argus will provide. They do analytics and thus you end up with another one of those “secret scores” on your record somewhere.  why even the doctors have trouble knowing they are in network, much less patients trying to figure all of this out. Insurers make money by making contract complex and this is no exception. Doctors don’t even have a say here as United and their cost algorithms are calling the shots. So if you hear you can keep your doctor, well you can’t blame this one on Obamacare, this one is all the work of United this time. They have this algorithmic scoring system that uses some proprietary formulas and what it is, we don’t know. Do they tell the doctors, probably not as they would have to go in depth and explain how their algorithms work.

why even the doctors have trouble knowing they are in network, much less patients trying to figure all of this out. Insurers make money by making contract complex and this is no exception. Doctors don’t even have a say here as United and their cost algorithms are calling the shots. So if you hear you can keep your doctor, well you can’t blame this one on Obamacare, this one is all the work of United this time. They have this algorithmic scoring system that uses some proprietary formulas and what it is, we don’t know. Do they tell the doctors, probably not as they would have to go in depth and explain how their algorithms work.

to have data base C sitting around so they query and merge the two together and now you have a brand new repackaged data base. But let's say there were errors and flaws in either or both, well those move right along with it.

to have data base C sitting around so they query and merge the two together and now you have a brand new repackaged data base. But let's say there were errors and flaws in either or both, well those move right along with it. Richard Cordray is over his head in that agency with no data mechanics logic.

Richard Cordray is over his head in that agency with no data mechanics logic.