This goes back to the risk management “algorithm” that was run to find areas for reasons to end policies for those who were not “cost effective” in the course of doing business. Did they run the algorithms, yes they did but it’s not nice to have to see it along with the rest of the nation and save face, but it is what it is.

WellPoint Ran a Breast Cancer Algorithm to Target Members for Cancellation of Policies - “Fraud Detection” is the Catch All that Justifies the Reporting

Is is done? Not at all, just new algorithms that formulate differently. The insured will still continue to be “scored” and all insurers will be working on to determine every which way of intelligence they can gather, whether it be the web, wellness programs, etc. to predict what you are going to cost. This is a big taste of Wall Street here as I probably don’t have to tell you.

Healthcare Reform Bill – Expect “Fraud Algorithm” Use to Increase With “Scoring” the Insured With Our Leadership Trapped Embellishing Old Paradigms

Insurance companies themselves over a year ago said that algorithms and business intelligence is a solution to the health care insurance problems and part of it is a solution with new information and intelligence gathered, but how it is used is the question.

Health Care Insurers Suggest Algorithms and Business Intelligence solutions to provide health insurance solution

That brings me around to the next link about needing regulation. We can’t have the SEC running around with swords and daggers trying to enforce an industry who uses machine guns everyday, and yet this about what we have out there for current resources.

My Algorithm Didn’t Do That, Did It? Is There a “Department of Algorithms” in Our Future?

Here’s one more example on gathering intelligence below with “sensors” or medical devices that report data and it doesn’t stop there. Blue Cross is working with the data arm of United Healthcare, Ingenix who is a big consultant with Red Brick to work on “behavioral underwriting”, in other words the data they analyze will help them estimate what your cost is going to be. This is nice for United Healthcare as they get revenue both ways, from their own policies and they get to collect consulting and transaction fees from Blue Cross. No wonder they make so much money as they have both consumer clients and other insurance companies as clients.

Wellpoint Enters Contract Agreement with Red Brick for Behavioral Underwriting

There are also other 3rd parties who do pretty much the same thing with algorithms and business intelligence software. Below is an example of a 3rd party working with a Medicare Part D company in southern California and just an FYI, TriZetto is owned by a private equity firm in the UK, so that may not make you feel too warm and fuzzy either.

CareMore Live On TriZetto's Clinical CareAdvance System Algorithms - Healthcare Business Intelligence

So in short we certainly have to live with insurers but if they were businesses that had higher ethics and not so many of those mirrored from Wall Street, it could be a different story and the fact that they are for profit is pretty much something nobody likes except the investors. Health insurance has gotten away from the basic business model it was set up to be years ago and now everything is down to a dollar with ethics struggling to survive.

If you need more proof on this trending, read the link below on how ethics can be removed for a price if they get in the way of profits.

$25 Million Dollar Donation to Charity Included in New Agreement for Caritas to “Lose Their Religion” if Working With Catholic Ethics Becomes “Materially Burdensome”

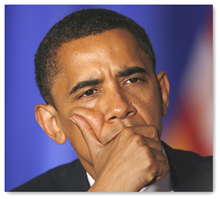

Unpleasant memories die hard and the President saw first hand what it was to battle claims and the hell is own mother went through so I don’t see this thought process and perception changing any time soon to create an illusion that is not the truth in how companies have conducted themselves.

Obviously this woman is “bent” on being “right” rather than thinking about doing the right thing it appears, as “their algorithms say so” with those patients just wanting to get care. BD

Angela Braly keeps sparring with President Obama’s administration—this time with the president himself.

The CEO of Indianapolis-based WellPoint Inc. dashed off a letter on Sunday trying to rebut Obama’s weekend criticism of the health insurer for reports that it seeks out breast cancer patients to cancel their policies.

Such claims were reported last month by the news service Reuters, but WellPoint called the story “inaccurate and grossly misleading.

WellPoint did change its rescission policy two weeks ago to match the new health law signed by Obama in March. The new law says health insurers can cancel a customer’s policy only in cases of fraud or intentional lying. Previously, health insurers would sometimes cancel a customer’s policy even if he or she omitted or misconstrued information, even unwittingly.

Braly chided Obama for continuing to attack health insurers—as he did effectively in working to get the law passed—at a time when implementing the new law requires greater collaboration.

“If we are going to make this law work on behalf of all Americans,” Braly wrote, “the attacks on the health insurance industry—a valued industry that provides coverage for more than 200 million Americans—must end.”

0 comments :

Post a Comment