The insurance exchange business since it was created under the Affordable Care Act has certainly changed it’s landscape since the law was signed. In addition to the state run insurance exchanges, there  has been a flurry of “private” exchanges, some run by insurer subsidiary companies appear. This just goes to reinstate how things move rapidly in the world today and don’t stay the same for very long. I would guess insurers want every opportunity they can to have exposure to consumers to get their product offerings out there, but how this rolls out, we just don’t know yet. Are the exchanges going to be productive and carry a model that works? We don’t know. When you remove the over glorified word “exchange” it still health insurance contracts and a few weeks ago I wrote an article about the negotiations of such are “just a bitch” which I think pretty well describes is with the number of disputed health insurance contracts in the news.

has been a flurry of “private” exchanges, some run by insurer subsidiary companies appear. This just goes to reinstate how things move rapidly in the world today and don’t stay the same for very long. I would guess insurers want every opportunity they can to have exposure to consumers to get their product offerings out there, but how this rolls out, we just don’t know yet. Are the exchanges going to be productive and carry a model that works? We don’t know. When you remove the over glorified word “exchange” it still health insurance contracts and a few weeks ago I wrote an article about the negotiations of such are “just a bitch” which I think pretty well describes is with the number of disputed health insurance contracts in the news.

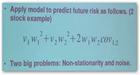

Contracts and their negotiation processes have certainly changed and the way the insurance carriers bid…just read the news. Complexity of course adds to this and we see things like this with once  carrier hiring the former executive from HHS accredited with writing a lot of the Affordable Care Act on their payroll at a VP now? It just makes one wonder what the other insurers might have to say about this? Are lawsuits and hiring former Assistant Attorney Generals as general counsel and other examples of such becoming the norm? It’s all about those algorithms for profit, created by Quants for banks and companies with CEOs that can’t even begin to explain to consumers and Congress for that matter as to how they work. Scroll down and look to the left on this blog for some great educational videos and see if you have been duped a bit and see how fictional math enters into corporate business models today. Here’s some back links on this topic.

carrier hiring the former executive from HHS accredited with writing a lot of the Affordable Care Act on their payroll at a VP now? It just makes one wonder what the other insurers might have to say about this? Are lawsuits and hiring former Assistant Attorney Generals as general counsel and other examples of such becoming the norm? It’s all about those algorithms for profit, created by Quants for banks and companies with CEOs that can’t even begin to explain to consumers and Congress for that matter as to how they work. Scroll down and look to the left on this blog for some great educational videos and see if you have been duped a bit and see how fictional math enters into corporate business models today. Here’s some back links on this topic.

United Healthcare 3rd Quarter 2012 Profits Increase 23%–Algorithms and Formulas Create Complex Multifaceted Business Models To Do It Again And Those Health Insurance Contracts are Still a Bitch

Update: UnitedHealthcare Sues Department of Defense Over Tri-Care Contracts–They Said They Would Do This – Is This A Case Of My Algorithms Are Better Than Yours?

US Health Insurance Regulator Leaving to Take a Job at UnitedHealth Care As Vice President of the Optum Division – Moving to the “For Profit Side” With Business Intelligence Algorithm Dollars To Review

When you get right down to the topic, these are just more complicated health insurance contracts to be negotiated and then there’s a new line up of other folks that will sell consumers software that will help them navigate the complexities. If they aren’t selling software to consumers they offer it free and scrape and mine your data it seems so they get you one way or another.

Aren’t These Health Insurance Contracts a Bitch!

A lot of these companies show up in “Incubators” or “Accelerators” and guess what, insurance companies are right there to sponsor too, as we all know all start ups don’t make it but when looking to expand their own IT needs, it is a good place for insurers to shop for “cheap code” either by investing to maybe one day buy or buying it now. I’m just following the code and data trails here.

New York Digital Health Accelerator–Health IT Hub For Emerging Technologies–Remember All Start Ups Don’t Make It And It’s A Potentially Good Place for Health Insurers to Shop for Inexpensive Application Code

I know there’s been a lot of time and money spent here on this but again the changing world around us changed the landscape once again. What makes this even a bit more complicated too is that with the number of acquisitions and mergers, heck some people don’t even know who the corporate owner is of the companies do business with as it kind of gets disguised in the long daisy chains emerging today as a subsidiary may be 2 or 3 or even more steps down the ladder of ownership. What this can lead to is some questions for conflict of interest too. When a subsidiary loses a bid on one end are they in place for a different contract with another service? Yup this is happening but nobody talks much about it as again the long daisy chains kind of hide some of this. One thing to remember though is that corporate data chains are not dumb by definition and of course the entities exchange data of some sort and how much we don’t know but they do it as all you have to do is listen to a quarterly report on profits and they mention is then, especially if the subsidiaries are contributing to big dollar bottom line profits.

of acquisitions and mergers, heck some people don’t even know who the corporate owner is of the companies do business with as it kind of gets disguised in the long daisy chains emerging today as a subsidiary may be 2 or 3 or even more steps down the ladder of ownership. What this can lead to is some questions for conflict of interest too. When a subsidiary loses a bid on one end are they in place for a different contract with another service? Yup this is happening but nobody talks much about it as again the long daisy chains kind of hide some of this. One thing to remember though is that corporate data chains are not dumb by definition and of course the entities exchange data of some sort and how much we don’t know but they do it as all you have to do is listen to a quarterly report on profits and they mention is then, especially if the subsidiaries are contributing to big dollar bottom line profits.

Subsidiary Watch-Corporate Conglomerate Insurers Reduce Compensation Contracts Using One Subsidiary Then Market Same MDs With Another Subsidiary in Health IT

Here’s a few examples of contracts that have or are difficult to where everyone is duking it out and there’s more, just read the news.

Blue Cross Protesting Award of Texas Employee Retirement Health Plan to United Healthcare–Price Cut by $25 Million With Little or No Out of Network Coverage for Members

Blue Cross and United Healthcare Duking It Out In Nebraska Over State Health Insurance Contract–We Have More Subsidiaries My Cost Algorithms Are Better Than Yours?

State of Louisiana Rejects United Healthcare’s Protest Over Awarding Blue Cross/Blue Shield Contract To Manage State Employee Health Insurance–Battle of the Insurance Algorithms Continues..

So now let’s look at the other side of the coin, how does this affect doctors and hospitals…this back link kind of sums it up..

Doctors Going Broke–You Can’t Even Give a Practice Away–Only Folks Buying Them Are Hospitals and Insurance Companies As It Relates to Reimbursement and/or Profits

Here’s an example below on a private exchange and you can see this is a subsidiary of Wellpoint now since they bough the company. Later down the road will folks remember that Wellpoint owns Bloom, maybe and maybe not, but if profit arise, it will be noted on those quarterly reports and conference calls. Also don’t forget that with the bidding process, insurers now own a great number of HMOs across the country too, and big ones, so there’s a little note of interest there as well.

see this is a subsidiary of Wellpoint now since they bough the company. Later down the road will folks remember that Wellpoint owns Bloom, maybe and maybe not, but if profit arise, it will be noted on those quarterly reports and conference calls. Also don’t forget that with the bidding process, insurers now own a great number of HMOs across the country too, and big ones, so there’s a little note of interest there as well.

WellPoint & Partners Buy Bloom Private Health Insurance Exchange From Their Own Venture Capital Company (Sandbox) –Subsidiary Watch

So to sum all of this up, the exchange are just more contracts that could end up being a “bitch” as we see in the news today. Again this is complex rhetoric I think and leads us one step closer to a single pay system as I don’t know about you, but I’m getting real tired of corporate America making more difficult for me as a consumer and the lack of Algorithm knowledge in the government as they are fighting with one hand tied behind their backs. Consumers all hate math for the most part and dive into the OMG news in the press and the media drives so much of this and it keeps all of us distracted as to what’s really happening behind the scenes and this keeps the disparity alive in the US as you are Algo Duped. Did you hear the 60 minute interview with the former Goldman executive? He said it right out that they looked for the most non sophisticated consumers they could find, why? Not much changed there over the years, it’s an easy sell. I was in sales for 20 years and I didn’t sell that way at all but there are tons that do.

real tired of corporate America making more difficult for me as a consumer and the lack of Algorithm knowledge in the government as they are fighting with one hand tied behind their backs. Consumers all hate math for the most part and dive into the OMG news in the press and the media drives so much of this and it keeps all of us distracted as to what’s really happening behind the scenes and this keeps the disparity alive in the US as you are Algo Duped. Did you hear the 60 minute interview with the former Goldman executive? He said it right out that they looked for the most non sophisticated consumers they could find, why? Not much changed there over the years, it’s an easy sell. I was in sales for 20 years and I didn’t sell that way at all but there are tons that do.

So these exchange contracts will be full of complexities leaving most of us again wondering what corporate America is up to with the “Algorithms for Profit” and I see this something too that states and the federal government still needs to look at before it’s too late. The complexities and design of IT infrastructure for profit will continue to grow and the Killer Algorithms will move and take more consumer money. It is what it is, more links on that topic below.

Attack of the Killer Algorithms–Digest & Links for All Chapters–on How Math and Crafty Formulas Today Running on Servers 24/7 Make Life Impacting Decisions About You

Your exchange contracts with the insurer you pick will run on servers 24/7 and make decisions about your coverage and what is allowed today and what is allowed tomorrow as it changes as they update their business models. So is there a “real” future here other than just another bunch of algorithms for shopping for insurance..who knows..but that’s what it will be and this whole idea right now could already be dated as corporate business models move like rockets while the government still invests in snails in way too many areas. BD

California's health insurance exchange said more than 30 plans are expected to vie with one another for spots in the state-run marketplace opening next fall.

State officials, and those in other states, are eager to flex their purchasing power under the federal healthcare law by selecting only certain individual and small-business health plans for 19 different regions across California.

The exchange, branded Tuesday as Covered California, will negotiate with insurers for the best rates and will assist consumers and small businesses in choosing a plan by separating them into five categories based on cost and level of benefits.

Insurers who aren't chosen to be among the exchange's plans can still offer policies outside the exchange. But many people seeking coverage are expected to go through the exchange because they can get government financial and educational assistance.

California's four largest insurers in the individual market — Kaiser Permanente, Anthem Blue Cross, Blue Shield of California and Health Net Inc. — have indicated interest in the exchange. Smaller insurers and large hospital systems may offer health plans in specific areas.

Officials are expected to pick the winning health plans and negotiate rates by June. Consumers will start enrolling in the exchange next October for policies taking effect in January 2014.

http://www.latimes.com/business/la-fi-insurance-exchange-20121031,0,1916732.story

0 comments :

Post a Comment