Fortune put it right out in their article on why IBM was purchasing Truven Analytics, for the data. When companies acquire more data we all pretty much may know what goes next, more “big data” scoring and selling with consumer data. I’ve been writing about this now for around 4 years or so and it keeps getting bigger every year and so far, what do consumers get from all of this? Not much at all, but corporations get richer by the minute “scoring” consumers and selling the data so we all have quite a few ball and chain risk assessments attached to our ankles today, that either deny or allow access to something. You can look at a competitor of this effort, Optum Labs and what do we get from them? Same thing, a lot of nothing. We do get an occasional study that fills the air waves with a bunch of numbers that may tell us what the next risk assessment will be or is, but other than that, nothing. So far the yield for benefiting consumers has been zero, just more risk assessments and segementation models to “score” us and our data to sell.

either deny or allow access to something. You can look at a competitor of this effort, Optum Labs and what do we get from them? Same thing, a lot of nothing. We do get an occasional study that fills the air waves with a bunch of numbers that may tell us what the next risk assessment will be or is, but other than that, nothing. So far the yield for benefiting consumers has been zero, just more risk assessments and segementation models to “score” us and our data to sell.

Truven, has already been using the deep mining IBMWatson algorithms for around 15 months to do number crunches and deep big queries. Truven as you may or may not know what the original Reuters data base and analytics programs and processes that was sold years ago Here’s some back links where I wrote about some of their updates and the eventual sale of the analytic by Reuters.

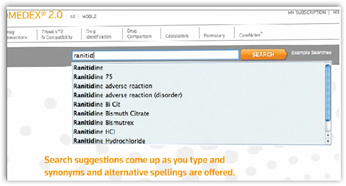

New Center For Comparative Effectiveness Research from Thomsonreuters With Micromedex Update & Mobile Software

Micromedex as those who have been around in healthcare for a while are all acquainted with the PDR big red book that was published for years. Here’s a short paragraph from the link above, so you can see gathering data in this area has been around for a long time, so you can see this extensive data mining fits right into the marketing of IBMWatson as a fix all for everything. Reuters got out of this business to focus on what the company was established for and that is news and media coverage.

“The new center will draw on unique information assets including the Thomson Reuters MarketScan(R) Research Databases and clinical data repositories, built for research scientists in the life sciences and for hospital pharmacists. The Thomson Reuters MarketScan databases house integrated patient-level data for populations covered by commercial insurance, Medicaid, and Medicare supplemental plans. This information includes inpatient, outpatient, drug, laboratory, and other data reflecting real-world treatment patterns and costs.”

Thomson reuters Plans to Sell Healthcare Unit By the End of the Year

You may or may not be aware of the fact that IBM has had 13 straight quarters of declining sales and you can read that all over the web, and, in addition they have bought more of their own stock back that almost any other company, which means instead of investing in the company itself, they just bought huge masses of their own stock back to inflate the value of the company and enrich the income of the CEO and other executives in the company. This happens with a lot of companies, but IBM and GE has been at the top of all of this.  Layoffs tend to occur to cut back at companies to finance such buybacks as well.

Layoffs tend to occur to cut back at companies to finance such buybacks as well.

We now have the XPrize and their latest promotion with using IBMWatson to “save the world again” and it comes back to using the technology to deep mine and find some big cure or whatever. If we go back in the past though, this is not the first time the XPrize was soaked in on such a promotion as you can read here about the $10 million that Wellpoint tossed their way a few years ago to “cure” healthcare. I saw it and so did many others that this was just a promotional joke of sorts as this was not a real contest to find any real outcome, just a media game and a way to raise some money. So when you see such promotions, there’s not much value or truth in the pursuit here, just more PR. When you finish reading this post, scroll on down to the footer and watch the first video “Context is Everything” by Professor Siefe from NYU and you’ll get the idea and maybe you wont’ be duped as much as he lays it out and ironically this is a presentation at Google headquarters telling those employees how they get duped. I used to enjoy the TED presentations and videos but they too anymore are just blending into the wall as it’s way too many “what it” and “if” perceptions of folks who don’t get it right anymore with their perceptions.

What Happened to the Healthcare X PRIZE – The 10 Million Donation from Wellpoint That Went Nowhere – PR Stuff

The Financial Times a short while back had quite a write up on IBMWatson and asks if Artificial Intelligence will save the “big query” machine and brings up a lot of good points from beyond the hype. They talk about how the machines is nothing like what you saw on jeopardy and how the technologies have been compartmentalized into various operations that again are nothing like what you saw on TV. A few lines from the article below which is well worth the read.

“But critics say that what IBM now sells under the Watson name has little to do with the original Jeopardy!-playing computer, and that the brand is being used to create a halo effect for a set of technologies that are not as revolutionary as claimed.

“Their approach is bound to backfire,” says Mr Etzioni. “A more responsible approach is to be upfront about what a system can and can’t do, rather than surround it with a cloud of hype.”

“It’s not where I thought it would go. We’re nowhere near the end,” says Lynda Chin, head of innovation at the University of Texas’ medical system. “This is very, very difficult.” Turning a word game-playing computer into an expert on oncology overnight is as unlikely as it sounds, she says.”

In addition IBM has begun marketing the APIs to where people can write applications to use the technology and this of course is a huge area for data selling and mining. Myself and many others on the web pinpointed this immediately with Welltok. Apps and companies like this are yet a further diving into the “dummy down” effect presented to the consumer with gamification and other lures to drag you into give away more of your personal data. Nobody likes this stuff but they keep pushing it under some obscure perception that it’s going to do something for you and present value, and there’s similar programs around that have little take up besides IBM doing the same thing, why this was so easy to recognize. Years ago, I used to write software so I have a real good idea on what goes on with the backside here and it’s a shame that consumers are marketed into what I call “Perception-Deception”.

IBM Watson Invests in Start Up Company Welltok–Big Data Joins Forces With The Data Selling Platforms…

Welltok Buys Wellness App Maker, Mindbloom, The Move To “Dummy Down” Consumers Is Alive and Well With Gamification Efforts That Persist To Hook Us In…

A couple years ago the Computer Scientist at IBM who created IBMWatson, David Ferrucci left and went to work for a hedge fund and you kind of wonder what may have been going through his head as IBM started marketing and changing the entire Watson project? Ferrucci was all over the headlines with Jeopardy when Watson was created and he took his skills over to Bridgewater. As it is with most folks in tech, maybe he of course knew something we didn’t as it was his creation. I was reading the other day a blog from Dr. Halamka, CIO of Harvard Medical and there was a quip in one of his posts about Health IT and the fact that there were all kinds of technologies in healthcare that have value and it was “not” going to be IBMWatson saving the day, as other technologies out there were just as good if not better.

IBM Computer Scientist Leaves IBM Watson To Write Code and Models for Hedge Fund Wanting Cognitive Edge, Those Money Making Black Box Models Have Become More Complex To Create and Build..

IBMWatson has moved into an office in the Silicon Valley and of course now we have the usual perception deception associated with a lot of their technologies as well in the fact that too much of the time they sell you on a risk assessment being some type of a diagnosis and you have to watch carefully what they do with their marketing all the way around as everything is not as it seems.

Silicon Valley Is At It Again Confusing the Public With Calling Risk Assessments a Form of A Diagnosis Tool…

Actually before TED took a turn for more mass marketing, they did produce a lot of good videos and one from Ivan Oransky, who was formerly with Reuters Healthcare did a great video on this topic and how big data is being used and the “Moneyball” effect. He’s also a doctor and brings about how queries and predicting knowledge is limited and how folks are duped with “pre-conditions”. Take this one to heart and pay attention as this is what you are getting today and of course IBMWatson is right in there to market all of these “pre-conditions” and the ball and chain risk assessments around your ankles get heavier and heavir as more as assigned to you, and of course this data and scoring gets sold. You have to have a high tech experience of pregnancy now, and “pre-death” is something we have all been assigned!

So this expansion of IBMWatson with the deep query mechanisms will add even more “risk assessments” to your data trail and you will be sicker than you could ever imagine, data wise that is. Look what happens when you fill a prescription, if the data is not there, you are defaulted to being a non compliant medication adherent patient, based on flawed data on bad risk assessments.

Patients Who Pay “Cash” When Filling Prescriptions Are Now Called “Outliers, Pharmacists Required to Fix Outliers as They Show Up As Non Medication Adherence Compliant With 5 Star Systems Full of Flawed Data…

So IBMWatson is not there to really do a lot for you, directly as the consumer, it’s there to make money for IBM to produce and sell more risk assessments as we are going over the top. Sure Big Data is needed and helpful with drug research and genomics as that is that business, but to run each consumer’s life like a big risk assessment is wrong. This happens so corporations can sell all of this about you and profit. Do you get to see any of this “scoring”? Of course not as it’s all secret and in talking scoring, if you want to go back to some of the origins here, look at how IBM used scoring in Nazi Germany with punch cards, which of course is old compared to what we do today and see how IBM and Professor Watson did business. They didn’t care about people and Watson went in business with the Nazis to pad his pocketbook. I don’t normally bring things from the past up as such, but this is relevant and exactly what’s going on today minus gas chambers and a few other things that occurred. “IBM and the Holocaust” was a book written documenting all of this with some extensive research. Again, what were they doing? Scoring….and we have excess scoring of US Consumers taking place today, more extensive with technology. Watch the video and see what you think as I’m not the only one making this connection as folks with more recognition than me, like Snowden have said the same thing.

I wrote a post a while back about Excess Scoring of US consumers and also referenced the report created by the World Privacy Forum, which addresses the same thing of numerical equations, not explored for accuracy but rather proprietary math formulas and models used secretly to score all of us, which in the end turn out to be a method of segmentation to deny access. You can read the link below and look at what’s going on around you, insurers are controlling more and more Medicaid and Medicare across the US with contracts (they are not hurting for money) and are still paying dividends on the stock market today.

Excess Scoring of US Consumers, US Citizens-Scored into Oblivion By Proprietary Algorithms and Formulas, Never Duplicated or Tested for Accuracy-Profits of Big Business And A White House Executive Command To Continue the Abuse..

We’re not even allowed to see who’s scoring us anymore. Your data is resold and repackaged without your knowledge and why I feel it’s important to index and license those corporations selling our data as who are they? What are they selling? What score have they given us and who are they selling it to?

Index and License Data Sellers, Step One Needed for Any Consumer Privacy Efforts to Exist - Spurious Correlations and Flawed Data Risk Assessments Thrive To Erroneously Deny Access

Take a look at who’s running government healthcare in the US, Andy Slavitt at CMS, a one time Goldman Banker and executive quant at United Healthcare that made a ton of money selling algorithms and analytics for which his company Ingenix was sued all over the place. At HHS, Burwell a former chief of staff for former Secretary of the Treasury, Bob Rubin, who basically should be in jail today as he, along with Larry Summers and Alan Greenspan lead to the economic meltdown in the US with the Securities Modernization Act they pushed through during their times at the White House. Visit the Attack of the Killer Algorithms for all the videos you need to see on how it all played out. Videos will bring you up to speed if you want to learn on how this all took place.

executive quant at United Healthcare that made a ton of money selling algorithms and analytics for which his company Ingenix was sued all over the place. At HHS, Burwell a former chief of staff for former Secretary of the Treasury, Bob Rubin, who basically should be in jail today as he, along with Larry Summers and Alan Greenspan lead to the economic meltdown in the US with the Securities Modernization Act they pushed through during their times at the White House. Visit the Attack of the Killer Algorithms for all the videos you need to see on how it all played out. Videos will bring you up to speed if you want to learn on how this all took place.

IBMWatson is not the only technology here as we have the same thing going on over at Optum Labs too, for profit. Behind the big data seller IMS, United I believe is the 2nd largest healthcare data seller in the US. In the right hand corner of this page, visit the campaign to index and license data sellers with the video from the World Privacy Forum talking about how IMS got caught selling data of “lists” with all of us on them with no regulation at all in front of Congress.

IMS Health Buys Cegedim Information Systems to Include CRM and Intelligence Software - Data Selling Business Gets Healthier and Wealthier But Can’t Say the Same for the Health of US Citizens - It’s All About Making Money Selling Data, The Epidemic

So in essence, don’t buy the hype here and as word of warning, use cash when you can too as you may have read this week, Larry Summers now was stating the US should get rid of the $100 bill too. He’s over at the Lending Club now selling loans out as CDOs, same thing that lead to the mortgage crisis and is now doing stock buy backs, and again watch “The Warning” at the Killer Algorithms page for more on how that worked.

So again, think of the Hype here and how much money IBMWatson wants to make selling our data as again 13 quarters of declining sales and way too many stock buy backs versus reinvesting in the company has the pressure cooker on and we’re the target as it’s easy money one the algorithms are written and put in to place to rock and roll and we lose all the way around. It’s all about making money selling risk assessments and data and nobody’s minding the shop. Watch video number 2 below in the footer, the quant documentary to see what this is all about as now the quants have moved into healthcare and the end won’t be pretty at all when the same types of formulas that failed during the crisis in 2008 start falling again, this time in healthcare. In case you missed it, more CVS and IBMWatson hype here and CVS is already making $2 to 3 billion a year selling your data and wants more. They just want to the data to sell, create more consumer scores, valid or not and sell it for profit, nobody and I mean nobody is minding this shop. BD

CVS and IBM Watson Project–Please Make It Stop-13 Quarters of Declining Profits for IBM, Is This Is What We Get, More Algorithms Biting Us Constantly So More Data Can Be Mined and Sold Resulting In Excess “Scoring” of US Consumers..

And when it comes to big data analytics, the more data, the better, said IBM IBM 0.48% Watson Health general manager Deborah DiSanzo. Truven brings still more data into IBM, which has already assembled quite the data pool, both on its own and via acquisition.

With Truven, IBM gets “200 million lives which we can combine with 100 million patient records. We can combine our data sets together, including one of the largest democratized health records with electronic health records from Phytel, Truven, claims data, imaging data, genetics, medical health data and from all of that we can run analysis,” said DiSanzo told Fortune in an interview.

Truven, which has used IBM Cognos business intelligence software for years and has partnered with IBM’s Watson unit for the past 15 months or so, offers a wide array of data analytics services.

http://fortune.com/2016/02/18/ibm-truven-health-acquisition/

0 comments :

Post a Comment