Plastic surgery is not always a nose job or something cosmetic and there are cases such as this one here with a patient who literally had a big gaping wound that required surgery to heal properly. When you read below about the size  where you could put 2 hands inside the wound? This sounds to me like a major need for repair as one could be subject to all types of infections if not healed properly too.

where you could put 2 hands inside the wound? This sounds to me like a major need for repair as one could be subject to all types of infections if not healed properly too.

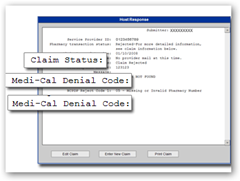

As the doctor states it will probably be granted on an appeal but here we have the perfect example of how the data lines up, is evaluated through a series of algorithms to determine qualification and payment authorization and still hits the wall, it’s all the formulas relied on by insurance companies and if data is not entered correctly on the claim, the software mechanisms deny the claim, this happens all the time and is why we can’t totally rely on data system for our care as it does not see people, only data which is culminated to determine profits with carriers who have to report dividends on Wall Street as that is their first area of concern, not healthcare for people.

This is why for 2 years now I have the word “algorithms”, along with it’s meaning plastered center stage on this blog. It is what it is and almost every decision we make today revolves around going to the computer for decision making information. With insurance companies most of this is automated so if a person gives the ok for payment and it is not documented in the data according to their own internal procedures, it this the “denial algorithm”. This is text long process on how to battle an algorithmically denied claim.

How to Fight Algorithmically “Scored” Health Care Claim Denials – Line Up and Deliver Your Own Data

It does make you wonder why fraudulent claims zip right on through and when you look at it from a dollars and cents standpoint, the same companies that scan, review and deny claims are the same ones making a profit from this process too, so how do fix that? They make money on transactions and it’s maybe a fine line here on what to deny and what to approve as with fraud prevention if you cut too many transactions out of the process, there goes the profits.

Little Progress on Fighting Healthcare Fraud – Look At Who’s Getting the Anti-Fraud Contracts

I said this over a year ago that we go through all the troubles of certifying medical records so they perform accurately but yet we don’t require insurance carriers to submit so we can certify how their processes work so we only have half the puzzle here and it makes it difficult for government insurance entities to audit and track all of this. We are living in the day of data, data and more data.

We cover one side and make feeble attempts with text and verbiage to try to regulate an industry that lives on algorithms, not going to work until we use the same types of resources they use.

“Department of Algorithms – Do We Need One of These to Regulate Upcoming Laws?

In this case it appears the doctors recommended this procedure as it would improve the quality of life for the patient, and I don’t think it’s too difficult to picture a big gaping wound and hole in one’s body that would need repair. This is yet one more example on how transactional profits and many of them are generated by 3rd parties too interfere with care and sometimes just make those involved in the entire process look pretty stupid and they waste a lot of administrative time with the doctors and the patients with this fire drill. This is the part of health insurance everyone hates, the “denial algorithms” designed for profit. BD

doctors and the patients with this fire drill. This is the part of health insurance everyone hates, the “denial algorithms” designed for profit. BD

After receiving a payment denial letter from an insurer for an operation I performed a few months ago, I figured it was time to share.

Health insurance companies play endless games with your local doctor in order to delay or avoid paying the bill.

Let’s talk by means of example:

Mr M is a 50 year old man who was admitted to a long term care hospital when I first saw him. He had a large wound on his hip that was big enough to allow both of your fists to fit inside. Wound care resulted in a clean, but very large hole. The doctors taking care of him requested the assistance of plastic surgery to shorten what would have been a 6-12 month expected healing time.

This patient has commercial medical insurance. I am the only plastic surgeon who works at this hospital. After seeing him and interfacing with his insurance company they agreed to the surgery. I even had to speak with some kind of insurance company medical director who requested that the patient be allowed to be discharged home prior to the operation, a skin graft.

Health Insurance Company BS – Out Of Network Edition » Truth in Cosmetic Surgery

0 comments :

Post a Comment