Well it appears we have a tool that is designed for you to enter all your information, especially if you have a number  of complex or multiple medical conditions to see what the potential outcome will be for purchasing a health insurance policy from Blue Cross. Again, with all this information you give, I am also guessing it is maintained on file for an actual under writer to use should one decide to apply. It’s yet one more algorithm to help consumers see what the criteria looks like when applying for health insurance so perhaps knowing the potential “sticker” price up front will help?

of complex or multiple medical conditions to see what the potential outcome will be for purchasing a health insurance policy from Blue Cross. Again, with all this information you give, I am also guessing it is maintained on file for an actual under writer to use should one decide to apply. It’s yet one more algorithm to help consumers see what the criteria looks like when applying for health insurance so perhaps knowing the potential “sticker” price up front will help?

Compare Health Insurance is the company making the offering with using the software/algorithms created by Blue Cross. We have seen a number of these types of services and websites appearing of late. Another one I wrote about a few months ago is called “InsureMonkey” and just for the name alone I don’t care much for their format, let’s keep a little decency in what we call our services for goodness sakes.

“InsureMonkey” Yet One More Way to Shop for Health Insurance–The Orbitz of the Insurance Market For Shopping Rates

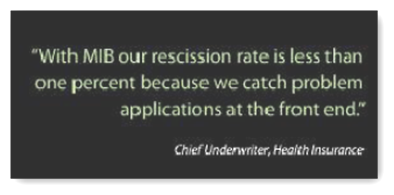

Now I could also guess that the information used to get a final rate will also be compared against other information on file with agencies such as the MIB too, so if something was left out either on purpose or by accident, prior claim and history information can be looked at if there is a difference. If you don’t know what the MIB is, take a look at the link below as they are a storage house of information with all kinds of healthcare and other insurance claim information on file about you and it can go back years. They also have some “flawed” data hanging out in there as well which many have found and getting some of those issues corrected have turned into massive headaches for consumers. So let’s don’t forget even though this tool is available, there will be other algorithms with analytical data used in the process.

The MIB – Health Insurance Bureau Business Intelligence Mining May Go Beyond Just Healthcare Information

What is the MIB - Medical Insurance Bureau - and how does it affect qualifying for insurance?

With risk analysis and current pricing algorithms in place with more levels of data analytics available, as a consumer, just be aware that all of these algorithms are in place as well and do have an impact on what you will pay. I don’t know if this tool has the capability to pull records from the MIB and combine it with what a consumer has entered, but I guess with all these various algorithms/websites appearing, we will soon find out. You can see when you visit the site most of the major health insurance carriers are listed as well as Anthem Blue Cross. On a side note, check out the credit on who created the website in Drupal, they are making sure they are noted here as well to maybe get some additional business and are search engine experts too as shown. I mention this as many sites do this but normally it’s found in the footer and not in the middle of the site. BD

Compare Health Insurance is pleased to announce an automated tool by Anthem Blue Cross that pre-screens clients with multiple or complex medical conditions. Compare Health Insurance can communicate electronically with an underwriter in order to determine a potential rating before submitting a California health insurance application, saving valuable time for our clients.

This service will save time completing a medical application and give California clients a more definitive price for a particular plan going forward. Compare Health Insurance believes the best route when dealing with our valued health partners is full disclosure of health issues so each party is confident on price and coverage.

Owner John Weiss says "this medical underwriting tool will allow our clients to get a firm rate on a plan without making a commitment to purchase coverage". Obtaining California medical insurance is now easier than ever with this new service.

http://www.sfgate.com/cgi-bin/article.cgi?f=/g/a/2012/06/05/prweb9570751.DTL

0 comments :

Post a Comment