It’s a bit complicated following the structure here of exactly how all of this fall in  together. Golden Gate Capital is the private equity firm and Infor is a private company with Golden Gate being the primary shareholder. The Infor Group appears to be well matched with software applications and as time moves on I guess we will see what stays and what may be integrated. There was talk that Oracle was interested in Lawson, but I guess not now. GSC Software Holdings is the affiliate of Golden Gate. There are a lot of banks in here to handle the debt financing to include Credit Suisse, Bank of America Merrill Lynch, Morgan Stanley, Royal Bank of Canada and Deutsche. It takes complicated algorithmic formulas today of course to line up and figure all this out.

together. Golden Gate Capital is the private equity firm and Infor is a private company with Golden Gate being the primary shareholder. The Infor Group appears to be well matched with software applications and as time moves on I guess we will see what stays and what may be integrated. There was talk that Oracle was interested in Lawson, but I guess not now. GSC Software Holdings is the affiliate of Golden Gate. There are a lot of banks in here to handle the debt financing to include Credit Suisse, Bank of America Merrill Lynch, Morgan Stanley, Royal Bank of Canada and Deutsche. It takes complicated algorithmic formulas today of course to line up and figure all this out.

From the website:

“Golden Gate Capital is a leading private equity firm with $9 billion in capital under  management. We generate superior returns for our investors through buyout and growth equity investments across a wide variety of industries. We partner with world-class management teams to make equity investments in situations where there is a demonstrable opportunity to significantly enhance a company's value. “

management. We generate superior returns for our investors through buyout and growth equity investments across a wide variety of industries. We partner with world-class management teams to make equity investments in situations where there is a demonstrable opportunity to significantly enhance a company's value. “

Infor offers software solutions for many industries and it was just last month that Lawson created additional analytics software. One thing today is there is absolutely no shortage of analytics software out there for one to choose from, no matter what business you are in and again, perhaps with aggregating some of these technologies in time, perhaps the selection processes will become easier in time. It will be interesting as time moves on to see how this all evolves and where branding gets new marketing focuses and what name, software and services will remain as primary focal points. BD

Lawson Introduces Lawson Analytics for Healthcare

ST. PAUL, MN – Lawson Software, which develops business application software for a wide variety of industries, including healthcare, is being acquired by GGC Software Holdings, an affiliate of Golden Gate Capital and Infor, in a deal worth roughly $2 billion.

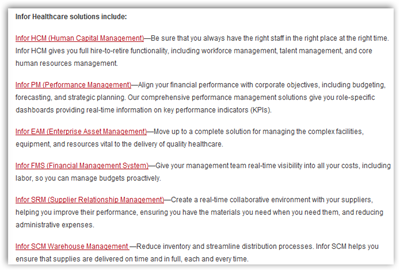

Based in St. Paul, Minn., Lawson offers software solutions that target financial management, human capital management, business intelligence, supply chain services, asset management, performance management, manufacturing operations and business project management.

Infor was launched in 2002 in Malvern, Pa., under the name Agilisys. Two years later, the company acquired Germany-based Infor Business Solutions, changed its name to Infor Global Solutions and moved its headquarters to Alpharetta. The privately held company currently has around $2 billion in revenue and more than 8,000 employees.

Lawson Software to be sold in $2B deal | Healthcare Finance News

0 comments :

Post a Comment