If you have not had enough algorithms on the web to help you out, well Google has one more for you to look at and it can help you find banks, credit cards and so on. If it were not Google providing this it would yet one more start up. Is the average consumer ready to digest all this information yet or is there a need? I guess only time will tell. BD

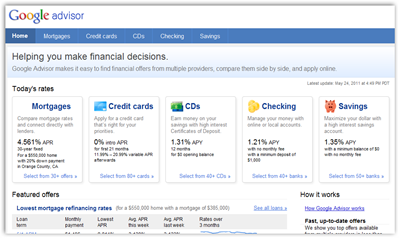

Last week the world’s biggest search engine widened its product offerings by launching Google Advisor, a tool to help consumers compare rates and apply for various financial products including mortgages, credit cards and bank accounts. For Google, it’s a no-brainer, lucrative move: The web giant gets paid each time you contact a mortgage lender from its web site, and an industry insider tells me marketers pay other comparison Web sites as much as $8 to $10 per click that leads consumers to mortgage sites.

But in a space already dominated by Bankrate.com, Credit.com, LendingTree.com, Mint.com, CardRatings.com and others, do we need Google as well?

Search results are pretty comprehensive, except for mortgage rate listings - more on that in a minute. As of Sunday evening there were more than 110 matching results for savings accounts, 118 results for checking accounts, 364 CD products and 87 credit card offerings. Right now Google is not getting paid to list these offers, which is probably why the number of listings are pretty high.

Google Advisor: Will New Tool Save You Money? - CBS MoneyWatch.com

0 comments :

Post a Comment