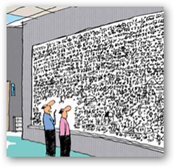

Healthcare payers and Wall Street are all connected and as you can see now the issues with rogue algorithms and identify are being discussed with having adequate  audit trails and accountability. We should be able to trace every transaction and follow it’ path in audit trail, same applies to healthcare but we never get to see those outside the clinical side where certification and rigid standards are the norm for medical record vendors.

audit trails and accountability. We should be able to trace every transaction and follow it’ path in audit trail, same applies to healthcare but we never get to see those outside the clinical side where certification and rigid standards are the norm for medical record vendors.

In making this comparison, we have the same issues too with checking “new” algorithms in healthcare and working from the blind side with payers. One true fact that holds anywhere is that sometimes we don’t know exactly what some algorithms may do, like under a perfect storm scenario. Usually in healthcare it leads to a claim rejection or something along that line. Just as the trading houses are running data over many exchanges, we have the same thing happening in healthcare with data touching many areas and accountability is top concern. On Wall Street, they want brokers to audit the algorithms and in healthcare, first of all we need to see them, and when it comes right down to it, they should be filed in a digital format so one can watch one operate with some fictitious sample data. Actually, that’s a good idea for future laws to incorporate some of those. One state legislature in New Jersey is on to this and has a bill with statutes that would allow health insurance algorithms to be audited as to how they were put together (computer code) as well.

New Jersey Legislature Getting Smart– Bill to Modify Claim Procedures to Include Asking For Insurance Company Algorithms-Bill A3334

Transaction fees roll a lot of money and profits around and recently I had a conversation with a physician’s group who dumped their automated algorithmic auditing system from a 3rd party and brought it in house with  2 employees doing the work, it got too far out of hand with expenses for the services. Now the 2 employees are using software of course and we are not talking going back to paper but they work with certain algorithms that analyze and mark claims for further investigation and it seems to be working well, and at least they have an auditing system they can afford.

2 employees doing the work, it got too far out of hand with expenses for the services. Now the 2 employees are using software of course and we are not talking going back to paper but they work with certain algorithms that analyze and mark claims for further investigation and it seems to be working well, and at least they have an auditing system they can afford.

This is a top notch IPA too that is not living in the dark ages and has invested in software pretty wisely. There’s so much money made in those transaction fees that come from checking and auditing claims and you never know if you are really getting your money’s worth. In just reading about the contract below, it made me wonder too how this will really work with finding enough fraud as the overall company makes money on transactions so to cut too many off, there goes the transaction profits. You need law officials to also help in the effort with fraud as algorithms are kind to crooks as they are better with numbers as they don’t see patients and have only one focus and that is fraud.

Kentucky Hires Ingenix on a 3 Year Contract to Detect Algorithmic Fraud With Medicaid Medical Claims

Bottom line is that the money has over a number of years has been shifted around and it’s all due to algorithmic controls and queries, whether it be Wall Street or Health Insurance, the same thing has occurred. As consumers we have swords and daggers while trying to battle those with machine gun technology and thus we are at the point to where those machine guns need to be accountable and the solution is audit tables and our own set of Algos to monitor.

IT IS ABOUT TIME THAT EVERY MEMBER OF CONGRESS AND OTHER  LEADERS IN THE US GET SOME “ALGO MEN” AROUND AS YOU CAN’T DO BUSNESS OR MAKE LAWS WITHOUTH THEIR HELP AND THIS IS A LOT OF OUR PROBLEMS WITH THOSE WHO CANNOT EMBRACE AND COME TO THE REALITY OF WHAT HAS OCCURRED THE LAST FEW YEARS, in other words what I call the “non participants” and those holding on to the paradigm of “its for those guys over there’.

LEADERS IN THE US GET SOME “ALGO MEN” AROUND AS YOU CAN’T DO BUSNESS OR MAKE LAWS WITHOUTH THEIR HELP AND THIS IS A LOT OF OUR PROBLEMS WITH THOSE WHO CANNOT EMBRACE AND COME TO THE REALITY OF WHAT HAS OCCURRED THE LAST FEW YEARS, in other words what I call the “non participants” and those holding on to the paradigm of “its for those guys over there’.

If one is running for office, then get those Algo Men on staff during a campaign so they can advise one as a candidate if your promises can be fulfilled as everything needs an IT infrastructure system and they can do the studies and help project. It will make campaigns a bit cleaner looking too and get rid of some of the “dumb and dumber” stories we hear in the news today too. You want to make sure though that you direct your Algo Men to create solutions that present accurate results and not all “desired” results as the 2 are not always the same. Here’s a good book that touches on a lot of how this goes on and yes there are some dark sides to some of the algorithms written for profit.

“Proofiness–The Dark Side of Mathematical Deception”–Created by Those Algorithms–New Book Coming Out Soon

This somewhat makes me feel good that I said this over a year ago:

“Department of Algorithms – Do We Need One of These to Regulate Upcoming Laws?

I think we need one of those or something close along those lines as algorithms and patents too are running together, software patents are basically just patenting a bunch of algorithms that are packaged. Bill Gates said that one. For all those who don’t get this, there’s always the simple Facebook algorithms to entertain and waste a ton of time there. Remember the big stink over the Goldman code, yup, those algorithms that make their money was at potential risk of being exposed.

Goldman Stolen Code – Has Algorithmic Fraud Become A Business Model in HealthCare Too?

Healthcare needs algorithmic style auditing too and we don’t get that now and are sometimes stuck with getting employees reading script that can’t explain what has happened as the claim may still be stuck in the algorithm pool of transactions and given codes, scores and number analyses that they can’t explain or understand. We have all had the script reading customer service folks and it’s not their faults as they are just doing what they are told but it doesn’t help when you want care or need questions on a claim that has been denied or changed.

Are We Ever Going to Get Some Algorithm Centric Laws Passed  for Healthcare!

for Healthcare!

“Not satisfied with milking the taxpayer, Goldman and friends have also escalated the profiteering arms race and are looking to skim everyone in the trading arena - partners, clients and each other. Can regulators keep up with the speed of their innovation and put in place sensible restrictions to protect the rest of us? “

In the news today, two other financial firms are talking about their new algorithms:

Deutsche Bank Launches New sophisticated execution algorithms

Quantitative Brokers Launches Suite of Algorithms for Interest Rate Futures

This is common occurrence as there’s ton of formulas being created every day so again having a sample operating digital format in a law without giving up any intellectual property as a visual would be nice and the algorithmic audit trails or we are never going to know how and when transactions transpired and the dis proportion of money in the US will get worse. On Wall Street and in Healthcare algorithms are running the show and we need accountability for the SEC with the technology and a full staff of “Algo Men” to enforce. BD

Broker-dealers who are sponsoring their customers' direct access to securities markets need to face a "higher level of accountability with respect to the algorithms they use,'' according to their chief regulator.

Richard Ketchum, the chairman and chief executive of the Financial Industry Regulatory Authority, said Tuesday that the higher standard of accountability needs to be applied to algorithms whether they come from the firm itself or a vendor and, most particularly, if the algorithms are "used across a wide range of borses.''

This is not to say that firms will be expected to know exactly how their algo will act with an event that has never happened before, such as the May 6 Flash Crash. Ketchum said regulators realize "each exceptional event" may cause difficulties with an algo.

"I think the appropriate place to focus now is to increase the auditing that firms do when they introduce new algorithms and particularly when their customers introduce new algorithms,'' he said.

FINRA: Accountability for Algorithms Needed - On Wall Street

0 comments :

Post a Comment