This has been kicking around out there since Whistleblower lawsuits were filed. Initially Humana was the first target and between United and Humana they have the most at stake here because they have most covered by Medicare Advantage Plans. This goes back to the Medicare risk assessment formula and whistleblowers were reporting that seniors were being coded with chronic care conditions for the sake of generating more money. Further information I read told of an automated process as well where risk fiddler algos were automated to up code as well.

“Medicare pays the Advantage health plans higher rates for sicker patients and less for healthy people using a complex formula called a “risk score.” But the HHS study spells out several ways health plans have inflated those scores, from reporting surprisingly high levels of medical conditions such as alcohol or drug dependence to billing for an inordinately high number of patients with complications of diabetes.”

A while back CMS announced they were going to re-run the Medicare risk scores to locate where they over paid, based on people that did not have such risk and follow up on information supplied by the whistleblowers in some instances. After the initial whistleblowers, CMS ran it’s own audit as they are required to do and approximated around $70 billion (a lot of money) was over paid to insurers with “risk fiddling”. The two links below will give you more information and history on all of this.

CMS to Rerun the Medicare Advantage Risk Scores–Dating Back to 2008 To Catch the Automated Risk Fiddlers of Said Insurer Fraud Amounting to Around $70 Billion–Be Ready For It…

CMS Discovers That Insurers Offering Medicare Advantage “Really Know How To Sharp Shoot A Model With Adjusting Risk For Profit”, A Common Everyday Occurrence in Financial Markets…

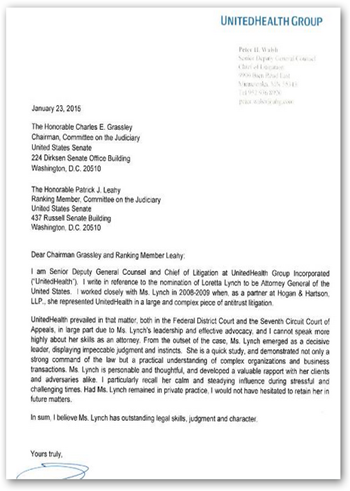

Medicare was asking that plans submit “deletes” on some of the data overpaid and coded and obviously this lawsuit kind of says United Healthcare and their insurer subsidiaries want no part of it. This gets interesting too as Loretta Lynch, head of the Department of Justice used to work for United Healthcare, representing them with anti trust lawsuits and a letter from their legal department sent to Grassley kind of sums that up as far as questioning cronyism in government healthcare.

of says United Healthcare and their insurer subsidiaries want no part of it. This gets interesting too as Loretta Lynch, head of the Department of Justice used to work for United Healthcare, representing them with anti trust lawsuits and a letter from their legal department sent to Grassley kind of sums that up as far as questioning cronyism in government healthcare.

In addition, HHS recently back peddled their own FDA agency on research data to join Optum Labs as well, so think about that one. Why did that occur? We do know that HHS Secretary Burwell was a former chief of staff for former US Treasury Secretary Bob Rubin who during that time was pretty much responsible for over turning Glass-Steagall in the financial sector.

HHS Joins Optum Labs as Research Partner–Back Peddles Support of FDA Sentinel Program That Does the Same Thing-More Impact from the Six Degrees of Bob Rubin Running Healthcare in the US

Speaking of banks, United Healthcare also owns a full custodial bank with over $3 billion on deposit that the use for HSA accounts and to loan money.

United Healthcare Owns a Bank-Optum Bank That Will Collect Your HSA Money, Give You a MasterCard to Empty It Out-Which Enables Even More Data Mining and Selling Transactions About You

The company is also busy building a network of Urgent Care centers and has quite a few already with the acquisition of MedExpress Clinics, of course where a lot of Medicare Advantage patients may seek care.

OPTUM Clinics Holdings, New Subsidiary Incorporated In 2015 Raises Over 36 Million (Exchange of Shares) From Investors Unknown-Form D Used to Maintain Secrecy Of Who They Are For Now…

We also know United is no stranger to lawsuits as it was around 5 years ago that United sued the DOD to get a portion of the Tri-Care Contract award for the west. It was an award that was met with a lot of protest as well. Over the years too I have written several posts on other lawsuits United has filed if they were not chosen for several government management contracts with healthcare. Nothing was ever said about the lawsuit other than United was awarded the contract after the lawsuit was filed. United of course has huge foot print in the military as well and even has a separate military service subsidiary as well. Big contractors like LHI are part of that division who are contracted to the VA for disability evaluations and for large deployments of the military with vaccines, etc.

Tri-West (Tri-Care Contract) Healthcare Begins Switching Members & Services To United Healthcare, The Contract Awarded After the Insurer Sued the Department of Defense

Ok so what’s going to happen here? I’m sure Humana, Aetna, and others will be waiting to see how this turns out as they too are on the hook for risk fiddled claims as well where members appeared to be sicker than they may have been due to coding and adding more risk. Alcohol chronic conditions was one that was easy to code in and so folks were easily coded to have that affliction to generate a higher payout. BD

Forty-one companies under the UnitedHealth Group umbrella, led by UnitedHealthcare Insurance Co., have set their sights on blocking Medicare Advantage regulations governing the returning and reporting of overpayments by filing suit against the Secretary of Health and Human Services in a federal district court in Washington.

The suit, filed last week claims that the rule on overpayments promulgated by the Centers for Medicare and Medicaid Services in 2014 doesn’t follow the text of the Medicare Act, which requires that CMS assess the health status traditional fee-for-service Medicare participants and Medicare Advantage participants similarly.

The insurers claim that this violates the “actuarial equivalence” required by the Medicare Act because it allows traditional fee-for-service Medicare participants to have all their reported health claims paid without requiring a comparison to the underlying medical records while forcing Medicare Advantage plans to do a searching audit and return a significant portion of their payments or be potentially subject to False Claims Act liability.

0 comments :

Post a Comment

Click to see the code!

To insert emoticon you must added at least one space before the code.