As the article mentions it is now in the quiet period and the name cannot be divulged. IPO Village was the portal that handled the crowd funding.  The company is not a start up and has been around for 6 years so I am guessing the IPO and crowd funding purpose was to ready the company for the IPO. The SEC has to give their stamp of approval all who signed up will receive their notice that the offering is is open for investment. The company’s product uses ultra sound technologies for cellulite removal and I can almost bet if I searched a bit it’s probably on this blog:)

The company is not a start up and has been around for 6 years so I am guessing the IPO and crowd funding purpose was to ready the company for the IPO. The SEC has to give their stamp of approval all who signed up will receive their notice that the offering is is open for investment. The company’s product uses ultra sound technologies for cellulite removal and I can almost bet if I searched a bit it’s probably on this blog:)

If you want to read more about the company there’s a lot to read up on and it gives you just about everything about the product except the name at the IPO Village website. This is a good example though of crowd funding for companies that are established and need to raise money as it’s not just limited to a start up. BD

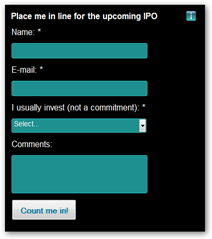

What is unexpected is that the crowd funding model is being used for an SEC qualified IPO for the issuance of stock. IPO Village will establish customer accounts with offering companies that will enable account holders to bid for IPO shares, with the priority order established by the order of funds deposited.

customer accounts with offering companies that will enable account holders to bid for IPO shares, with the priority order established by the order of funds deposited.

As mentioned previously, the first IPO Village enabled account has received $1 million in deposits from investors that want to be in line to bid for shares of the first ever crowd funded IPO. The deposits are held at the IPO issuing company and are submitted through the company's website, accessed through IPO Village acting as a portal. The name of the company going public is not revealed to the general public at this point because of SEC restrictions. Obviously the name of the company is revealed to individuals who apply to make a deposit.

The company has developed patented solutions for non-invasive  cosmetic weight-loss procedures. The company's technology is FDA-cleared and CE Medical Marked. It has been on the market for more than 6 years and is franchised in 13 countries with 130 installations and growing.

cosmetic weight-loss procedures. The company's technology is FDA-cleared and CE Medical Marked. It has been on the market for more than 6 years and is franchised in 13 countries with 130 installations and growing.

(IPO Village is unable to name the company as it is currently in an SEC "Quiet Period".)

The IPO Village business model is much different than the traditional way that IPOs have operated. And the difference starts with the fact that IPO Village is a not-for-profit operation. It operates as a portal and information site. There is no underwriting, there are no brokers and there are no investment bankers' fees. The portal establishes a direct contact between the company going public and the registered members who wish to buy the IPO.

http://econintersect.com/b2evolution/blog1.php/2012/10/04/first-ever-crowd-funded-ipo

0 comments :

Post a Comment