If you are not familiar with the MIB (Medical Insurance Bureau) there are several posts here on the blog so do a search. The MIB has been around since 1902 collecting information used to share with insurance companies to use to evaluate underwriting procedures for you the consumer, when you apply for life and  health insurance. With technology today, the calculations and methods used have soared with areas of risk management assessments.

health insurance. With technology today, the calculations and methods used have soared with areas of risk management assessments.

The MIB – Health Insurance Bureau Business Intelligence Mining May Go Beyond Just Healthcare Information

As business intelligence increases to find out every stick of information about individuals, so goes the MIB, the Medical Insurance Bureau. What is alarming as far as information contained is the fact that it can and does go beyond just claim information. Your credit report may be in here as well as your driving records. If you read below there’s a little additional information quoted that could be here.

What is the MIB - Medical Insurance Bureau - and how does it affect qualifying for insurance?

This new affiliation is all about data and the ability to evaluate mortality risk, in other words what is your anticipated time to check out. This does make one a bit uneasy when you see derivatives like this on the market where pools of diseased groups carry on a life insurance policy and bet on the life expectancy, pretty sick in my estimation, but companies provide them the data to do so and they make a lot of money at it.

It’s all about those algorithms once more. The link below goes into more detail and with the life insurance policies paid for by investors when a senior cashes out there portion continue to live on. In other words you cash out and the part that was held by the company gets rolled over to a group of investors where the policy lives on and based on what is known about your health, your policy gets put into a “disease” group and people hedge and bet against how long you may live, or how long a “disease” group will live. If you are in a “disease” group and you live too long, investors lose money. This is well worth the read to find out about how this wagering on human lives takes place.

'Dead Peasant' Life Insurance Policies - Human Hedge Funds The Next Bond Issues

Below is an example of the data being collected that could be used for such processes, it’s all there in motion.

HooperHolmes is also actively traded on the stock market exchange. The MIB also looks to be doing some updated marketing with their site that links to MIB Solutions and again this is the data base of all medical information shared by insurers.

One of the services and revenue generating functions is the $75.00 policy holder search, so in the case of a death, all the information can be gathered in one place. Attorneys make big use of this.

From the website:

“MIB Solutions, a wholly-owned subsidiary of the MIB Group, Inc., develops and markets products and services that help insurance companies make better, more  informed underwriting and risk management decisions. In addition to new products and services, our mission is to expand MIB's core fraud detection and deterrence services into new markets.”

informed underwriting and risk management decisions. In addition to new products and services, our mission is to expand MIB's core fraud detection and deterrence services into new markets.”

“These core competencies, combined with our unique industry positioning, make MIB Solutions, Inc. a leading provider of risk management products and services that give insurance executives the capabilities they require to improve business performance, increase effectiveness and, ultimately, enhance profitability.”

These are the tools the insurance companies use to help them insure profitability and now we getting closer to predicting your life expectancy so they can estimate how long you will be around to have to cover expenses relative to your health and life insurance.

The data analysis is now creating “scores” so you are rated and projected expenses are related to what premiums you may be charged. With the new co-ops for health insurance coming of age, you can bet this is going to generate a lot of income as all are going to want to know what it is going to cost them and how long to provide insurance for you.

As a consumer, you can always request a copy of your file, so you can see what had been added about you, all the information added by insurers from information received from various sources, mostly health insurance claims, but also items like driving records as noted above are now starting to appear.

This is “big brother” in the insurance business to put it mildly and there’s not much in the way of privacy here any more either. Basically the area of responsibility is being dropped back on the consumer to identify and correct any mistakes corporations and other healthcare firms have added over the years. If there is any errors or detection of fraud, it’s now on your back to fix or you could not get covered.

“MIB, Inc. is the premier provider of fraud detection information for individually underwritten life, disability income, long-term care and critical illness insurance. MIB member companies rely on its Checking Service™ for the fast, secure aggregation and exchange of data to combat fraud, improve underwriting effectiveness and increase product line profitability, while ensuring fair pricing for all applicants.”

They sell software now too and offer outsourcing services too with all types of data base information.

Anyway if you have read this far, it really doesn’t make you want to even think about having any type of a physical or test and really tends to substantiate the need for a single payer system is this is not doing any benefit for the patients/consumers when they have to worry and take time to track down all the information that was added to their file over which they had no control to begin with, and all of these processes they create, make millions if not billions of profit that we pay for.

When knowing that information is going to be used against you for profit instead of being used for better care everyone wants to just flat walk away as there may be some good analysis work coming out of this, but it’s not worth the trade off and is all disguised nicely in packages of such for profiting on human lives in some areas and denying care in others. This is truly a very sick system and why we pay so much for care.

With HooperHolmes you have yet even one more entity that will send you an “at home diabetes test” so they can have their data for risk assessments, as if there’s a shortage of industries, like pharmacies and all kinds of other wellness programs offering this. If you want to know what is really going on behind the scenes, I recommend looking at all of this as you may be shocked at how you are really just becoming a piece of data with a dollar sign attached to your head and the way that all of this is promoted seems to truly lack ethics and their marketing efforts and desire for dollars is just shown by looking the site and the language used in their marketing, nothing to hide here and you would have to be living under a rock not to see it. This is how your life and wellness is presented to investors for profit. BD

BASKING RIDGE, N.J., Jun 02, 2010 (BUSINESS WIRE) -- MIB Solutions, Inc. and Hooper Holmes, two companies embedded in the workflow of every North American life insurer, have formed a strategic alliance to help insurers better evaluate excess mortality risk in their book of new business using MIB

Solution's Audit Focus, and lab data from Heritage Labs, a division of Hooper Holmes.

Both MIB Solutions and Hooper Holmes are industry-leaders in research and analytics relative to the impact medical impairments have on life insurance risk assessment. Together, these firms have the resources and the data to provide unique analytics and new risk management products to their overlapping members/customers in the life insurance industry.

"Audit Focus with lab data lets insurers take the pulse of underwriting so they can more closely align mortality risk with company expectations to increase performance," said Stacy J. Gill, executive vice president of MIB Solutions. "We anticipate this will be the first of several collaborative efforts between our companies to help the industry better manage mortality risk."

Heritage Labs has also developed innovative mortality and risk scores, providing a more efficient and cost-effective means to accurately classify applicants and generate reflex tests.

About MIB Solutions

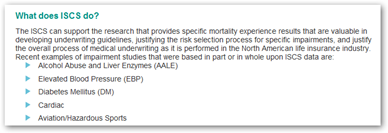

MIB Solutions, Inc., a wholly owned subsidiary of the MIB Group, Inc., develops and markets products and services that help insurance companies make better, more informed underwriting and risk management decisions. In addition to new products and services, its mission is to expand MIB Inc.'s core fraud detection and deterrence services into new markets (www.mibsolutions.com).

About Audit Focus

Audit Focus is provided by MIB Solutions, Inc. exclusively to members of MIB Group, Inc. for assessing and managing their life underwriting risk and not to determine the eligibility of individuals for insurance or benefits. Audit Focus reports are only generated on recently issued policies for which applicants authorized the use of MIB, Inc.'s fraud detection service known as the "MIB Checking Service."

About Hooper Holmes

Hooper Holmes /quotes/comstock/14*!hh/quotes/nls/hh (HH 0.80, -0.04, -4.76%) is a leader in collecting personal health data and transforming it into useful information, enabling customers to take actions that manage or reduce their risks and expenses. With presence in hundreds of markets and a network of thousands of examiners, Hooper Holmes can arrange a medical exam anywhere in the U.S. and deliver the results to its customers.

Hooper Holmes has four divisions. Portamedic provides a wide range of medical exam services nationwide. Heritage Labs tests millions of samples annually and helps life insurers improve underwriting performance by better applying the predictive powers of today's tests. Hooper Holmes' Services provides the industry's best value in data collection, tele-interviewing and underwriting services. Hooper Holmes Health & Wellness provides a complete service for wellness, disease management, and managed care companies including scheduling support, fulfillment of supplies, blood collection kits, medical screenings, lab testing and data transmission.

0 comments :

Post a Comment